19 August 2025

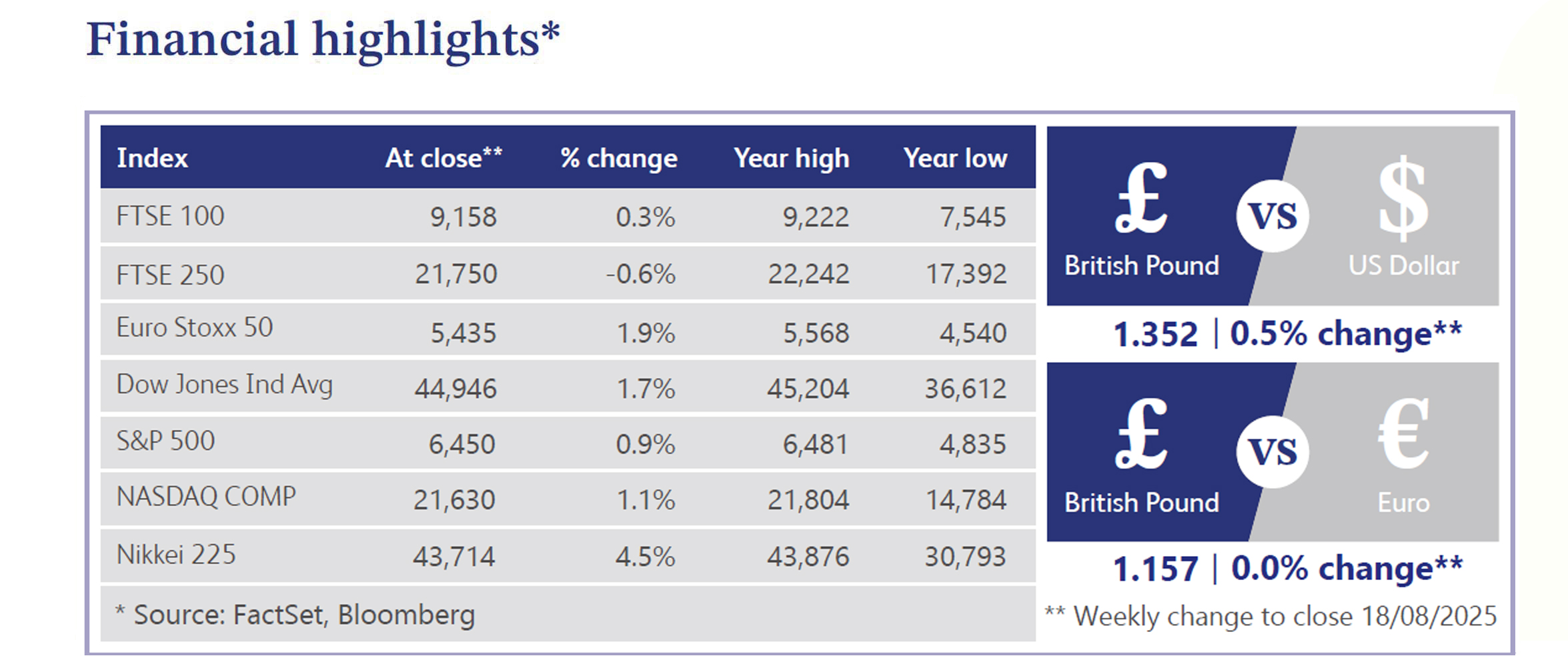

This week the UK economy continued to present a conflicting picture, marked by both resilience and fragility. London bore the brunt of tax-driven job losses, shedding 45,000 roles since October, as payroll tax hikes and a higher minimum wage hit private employers hardest. Meanwhile, artificial intelligence (“AI”) is beginning to reshape the labour market, with technology and finance job postings down 38% over the past two years. The Office for National Statistics (“ONS”) posted a gross domestic product (“GDP”) figure which surprised to the upside, expanding 0.3% over the previous quarter, with services, industry and construction delivering broad-based gains. However, exports to the US plunged to a three-year low under tariff pressure, underscoring trade vulnerabilities. Policymakers remain cautious as the Bank of England (“BoE”) warned inflation risks could limit scope for rate cuts, a view reinforced by wage growth holding at 5%.

The UK fiscal landscape is becoming increasingly strained as the government searches for ways to plug a potential £50 billion gap. HMRC data showed the number of dividend taxpayers will nearly double to 3.7 million in 2024/25, a direct consequence of repeated allowance cuts that risk undermining efforts to boost investment. The Treasury is also considering inheritance tax reforms, though experts caution the yield may be limited and could deter wealthy residents. Alternative proposals include broadening VAT to capture revenue more efficiently, while Labour voices are pushing for higher wealth taxes to share the burden more progressively. Against this backdrop, political tensions are rising, with difficult choices ahead between higher taxation, spending restraint or rethinking fiscal rules.

The UK faced contrasting signals in its capital markets, with concerns mounting over hedge funds’ £77 billion basis trades in gilts, with regulators warning such highly leveraged bets could destabilise the system if volatility sparks a fire sale. The Office for Budget Responsibility (“OBR”) cautioned that these short-term investors lack long-term commitment, amplifying systemic risk. At the same time, optimism is flickering in equities as stronger markets revive hopes of an autumn initial public offering (“IPO”) wave. Peel Hunt and City of London law firms highlighted regulatory competitiveness, though sceptics note London’s listings trend remains one of decline, with more firms leaving than joining, casting doubt over the market’s longer-term vibrancy.

The US equity market pushed higher, with the S&P 500 and Nasdaq closing just shy of fresh records while small caps extended gains. Market strength was underpinned by optimism over a September Federal Reserve (“Fed”) interest rate cut, with conviction reinforced by steady Consumer Price Index (“CPI”) data, a higher but likely contained Producer Price Index (“PPI”) print and solid retail sales. Big tech led selectively, with Amazon standing out, while managed care and airlines also rallied. Treasuries steepened as long yields edged higher, the dollar softened, and gold sold off. Trade policy lingered as a source of unease, with Trump hinting at semiconductor tariffs and chipmakers agreeing to revenue sharing on China sales. Despite resilient earnings, guidance remains cautious on macro and tariff headwinds, keeping sentiment constructive but watchful.

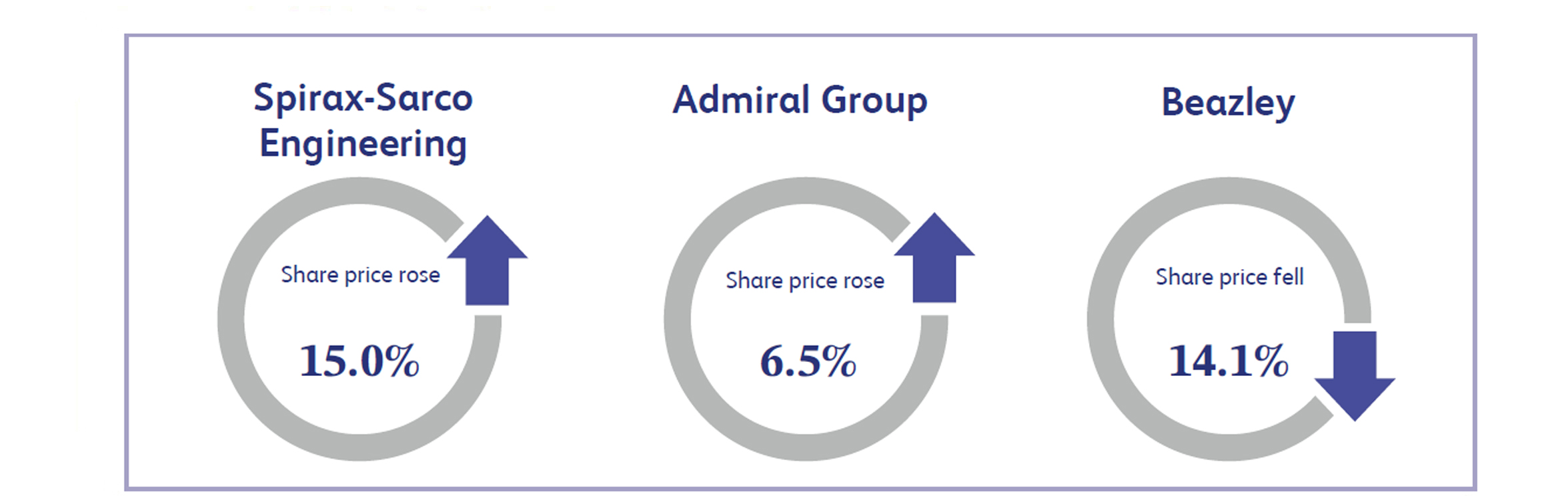

Spirax-Sarco Engineering, a Cheltenham-based manufacturer of thermal energy and fluid technology solutions, jumped 15% after forecasting accelerating organic sales in the second half, supported by a strong order book. First half revenue grew 3% organically to £822.2 million, surpassing expectations, while management reaffirmed full-year guidance and highlighted stronger than expected margin progress from cost-cutting. The upbeat tone marks a turnaround after earlier concerns over weaker Asian demand. Analysts called the update a step in the right direction, making Spirax the FTSE 100’s standout gainer on renewed confidence in its resilience.

Admiral Group, a leading UK insurer with a strong position in motor cover, climbed 6.5% to a record high after posting a 67% year-on-year rise in first half pre-tax profit. The results were driven by competitive pricing, operational discipline and robust performance in its core motor insurance arm, which offset broader market challenges. Shares crossed 3,600 pence, placing Admiral among the FTSE 100’s top performers. Investors welcomed the sharp uplift in profitability as evidence of strong underwriting resilience and pricing power, with the company now seen as well positioned to sustain momentum despite ongoing cost pressures across the insurance sector.

Beazley, the specialist insurer known for cyber, marine and property cover, tumbled 14.1% after cutting premium growth guidance to low to mid-single digits, down from earlier mid-single digit expectations. The update overshadowed half-year results that showed written premiums up just 2% to £3.19 billion and pre-tax profit down 31% at £502.5 million. Despite a healthy solvency ratio of 287% and underwriting profitability reflected in a combined ratio of 84.9%, investors reacted negatively to softer growth signals, given heightened sensitivity to revenue disappointments. The sharp share decline underscores concern about cyclical pressures in specialty insurance, even as Beazley emphasised its disciplined, risk-aware positioning.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management' own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.