18 November 2025

The case for a December Bank of England (“BoE”) rate cut strengthened significantly last week, as a string of data pointed to a stalling economy and a rapidly cooling labour market. Third quarter gross domestic product (“GDP”) growth fell short of expectations at just 0.1%, with the lack of momentum reflecting continued weakness. Further to this, UK unemployment figures rose to 5%, the highest since 2021, prompting traders to price in an 80% chance of a BoE rate cut in December. In addition, UK wage growth is stalling, with a recent KPMG/Recruitment and Employment Confederation survey showing near 4-year lows, indicating to the BoE that wage pressures are easing. All eyes will now be on Wednesday's inflation data, forecast to ease to 3.6%, which would support the case for a more dovish BoE.

On Friday, it was reported the Chancellor had abandoned plans for an income tax rate hike and instead will opt to extend the current freeze on tax thresholds to raise revenue, also hoping to honour Labour’s election manifesto pledge. Credit agency Fitch issued a sharp warning, noting that recent policy shifts highlight the importance of the UK maintaining its commitment to fiscal rules, which is crucial for preserving its ‘AA-’ credit rating. Improved Office for Budget Responsibility (“OBR”) forecasts reportedly enabled this U-turn, narrowing the fiscal gap to approximately £20 billion and giving the Chancellor £15-20 billion in unexpected headroom. With a rate hike most likely off the table, the focus has shifted to other measures. Reports indicate the Treasury is looking at reforming salary sacrifice schemes, which offer tax breaks, to help close the fiscal gap.

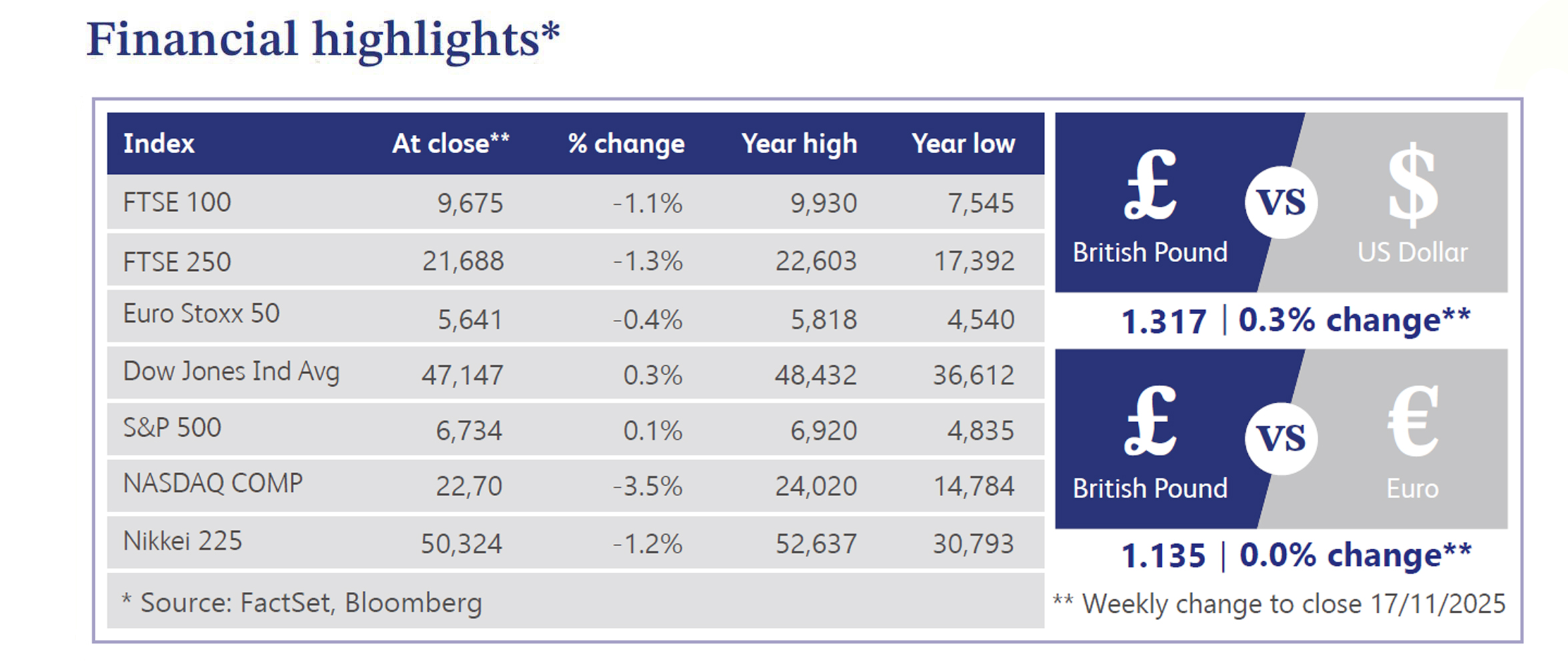

The FTSE 100 Index in the UK fell 1.1% and the FTSE 250 Index declined 1.3%. The Gilt yields jumped before partially stabilising, as investors were unsettled by the abrupt change in policy and the further uncertainty it created for the budget. The volatility was driven by concerns over fiscal credibility. Bond traders noted that the policy reversal undermines claims of stability, leaving investors struggling to gauge the true level of fiscal risk ahead of the budget. The British pound was little changed against the US dollar, closing the week at USD $1.32.

In the US, markets were mixed with S&P 500 flat, while the Nasdaq and Russell 2000 fell. This was linked to hawkish Fed sentiment, which pushed December rate cut bets down to 40%. The 43-day government shutdown also ended, leaving a sizable gap in economic data. This disruption could carry significant consequences by affecting inflation-linked social security payments and delaying key business decisions on hiring and inventory ahead of the holiday season. Treasury yields rose by 0.05%-0.06%. The US dollar rose 0.3% and Gold gained 2.1%. WTI crude oil was up 0.5%, as the Organisation of the Petroleum Exporting Countries (“OPEC”) revised its 2026 outlook to a balanced market.

In the UK housing market, Rightmove reported sellers cut asking prices by 1.8% in November, the largest fall for this time of year since 2012. The Royal Institution of Chartered Surveyors (“RICS") survey confirmed this, showing market activity "deteriorated sharply" in October as buyers and sellers postponed decisions. This slowdown is attributed to November budget uncertainty and property tax speculation. Looking ahead, the EY Item Club also predicts a slowdown next year, citing stretched affordability.

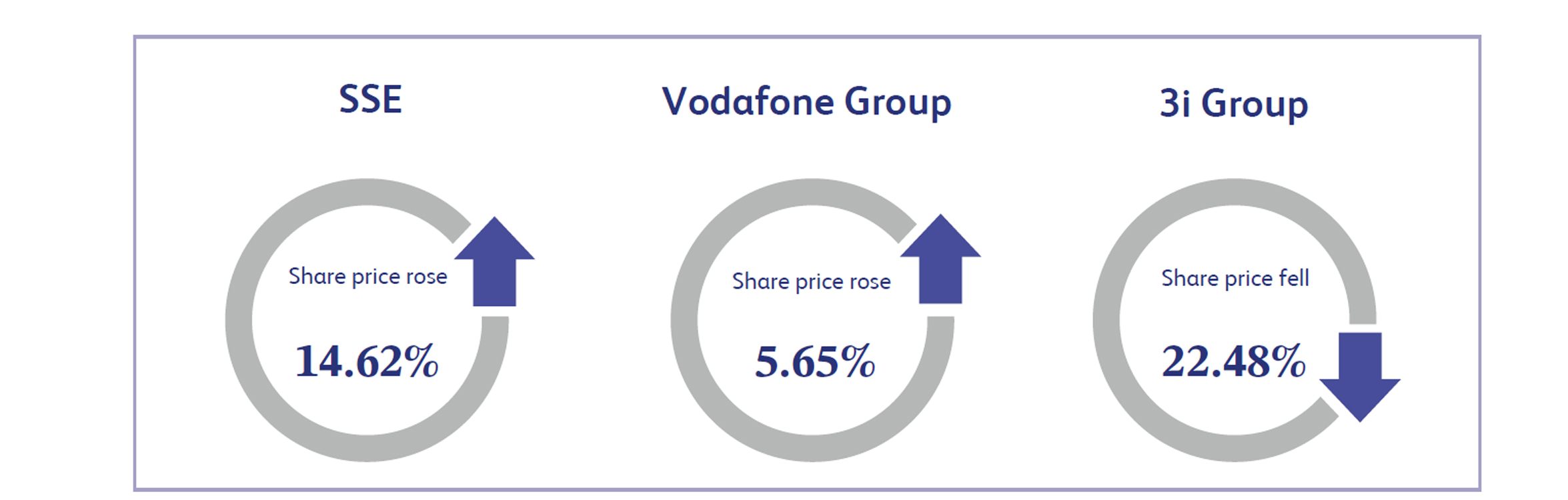

SSE, which is involved in the generation, transmission, distribution and supply of electricity, was the top performer of the week. Its share price rose by 14.62% following the announcement of a new strategic plan. The company unveiled a massive £33 billion, five-year investment plan, trebling its investment and significantly increasing exposure to UK electricity networks. To finance this SSE is raising £2 billion via a share issue. The market reacted positively, as the equity raise was largely expected and removed a long-running equity overhang. This is seen to provide clarity on the balance sheet and set attractive financial targets, which were supported by strong earnings growth potential.

Vodafone Group, the company providing telecommunication services globally, saw its shares increase by 5.65% for the week. This gain was a result of a favourable response to the company's interim financial results. The company reported total revenue growth of 7.3% and a return to top-line growth in its key German market. Management lifted full-year guidance for both adjusted Earnings Before Interest, Tax Depreciation and Amortisation (“EBITDA”) and free cash flow to the upper end of their ranges, citing "broad-based momentum" from its ongoing transformation. The market was also encouraged by strong shareholder returns, including a new progressive dividend policy with a 2.5% increase and the launch of another €500 million share buyback tranche.

3i Group, an investment trust with private equity and infrastructure portfolios, was the FTSE 100's biggest faller this week. Shares in the group fell by approximately 22.48% over the course of the week. The market reacted negatively to the private equity firm's cautious outlook, which overshadowed its half-year results. Despite a 13% total return, driven by top holding Action, the report raised concerns. Management warned that "softening trading conditions in France" could cause Action’s 2025 like-for-like sales growth to miss its guidance. This, combined with the CEO's caution over a "stagnant transaction market," prompted the sharp sell-off as investors priced in a more challenging future environment.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management' own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.