8 July 2025

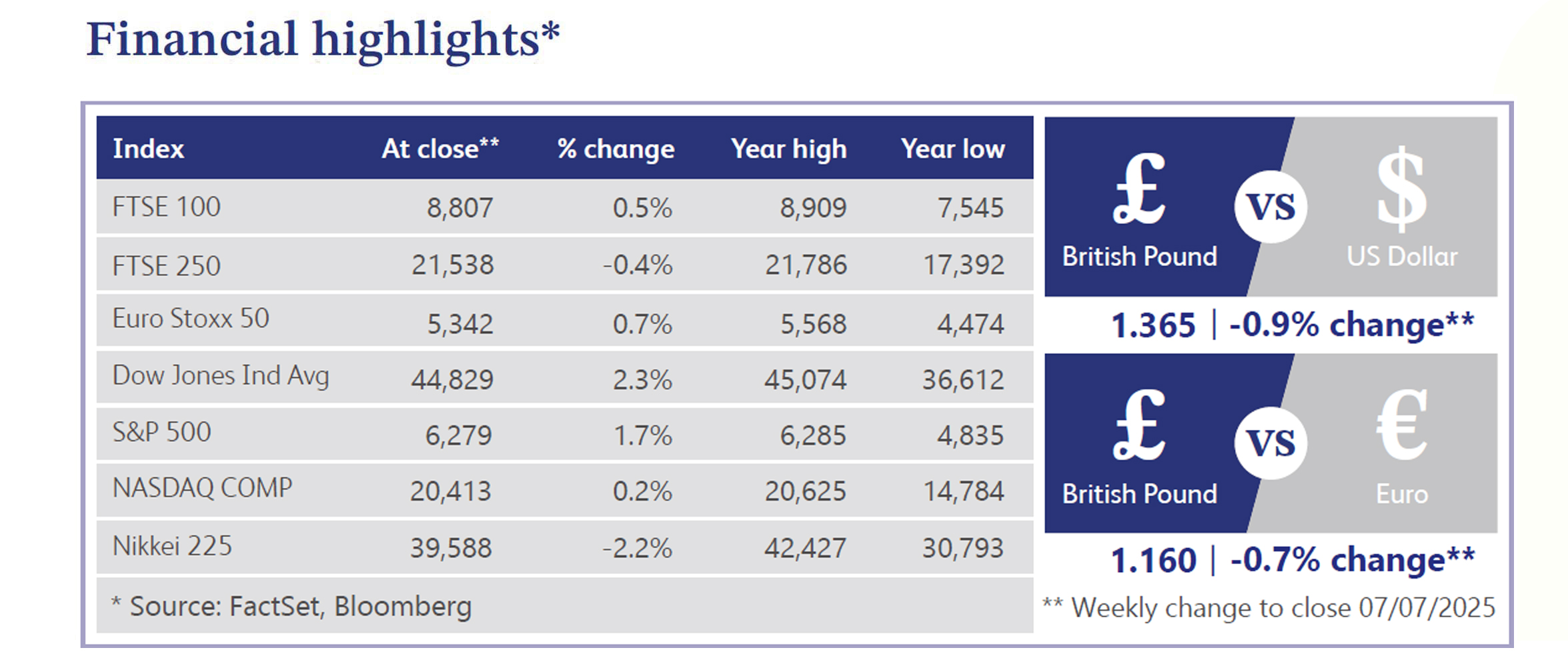

UK economic data last week painted a mixed picture. Retail sales remained subdued, with BDO’s High Street Sales Tracker rising just 0.6% year-on-year, marking six consecutive months of in-store sales growth trailing inflation. The construction sector continued to contract, although the Purchasing Managers’ Index (“PMI”) improved to 48.8, its highest level since January. Encouragingly, first-quarter gross domestic product (“GDP”) growth was confirmed at 0.7% quarter-on-quarter - the fastest in the Group of Seven (“G7”) - yet this momentum is unlikely to be sustained amid falling living standards. The services sector experienced its fastest expansion in 10 months, with a PMI of 52.8, but job losses persisted. The Bank of England (“BoE”) maintained a cautious stance, with Governor Andrew Bailey reinforcing hopes for rate cuts in light of a softening labour market and mixed inflation signals.

On the political front, Prime Minister Keir Starmer’s welfare reform agenda met significant resistance last week, leading to a late withdrawal of plans to reform Personal Independence Payments (“PIP”) ahead of a potential Labour rebellion, putting £4.6 billion in planned savings at risk. Meanwhile, the Office for Budget Responsibility (“OBR”) acknowledged a persistent optimism bias in its growth forecasts, raising concerns ahead of the autumn budget. Chancellor Rachel Reeves signalled potential tax rises to address a growing fiscal gap, with estimates suggesting £20 billion may be required. In trade developments, reduced tariffs on UK car and aerospace exports to the United States came into effect, though steel tariffs remain unresolved.

Rachel Reeves also plans to cap tax-free cash savings at £5,000 to encourage greater investment in UK equities, while retaining the £20,000 overall Individual Savings Account (“ISA”) limit. This move, expected to be detailed in the upcoming Mansion House speech, targets the £300 billion held in cash savings. Meanwhile, takeover activity surged, and UK listings are declining, with AstraZeneca’s chief executive reportedly favouring a US listing. Gilts and sterling rebounded following the Prime Minister’s endorsement of Rachel Reeves.

Across the Atlantic, US equities climbed during the holiday-shortened week, with the S&P 500 and Nasdaq reaching fresh record highs. There was a rotation away from second-quarter leaders, as value stocks outperformed while momentum lagged. Gains were seen in energy, banks, airlines and small caps, while sectors such as managed care, semiconductors, China tech and real estate investment trusts underperformed. June’s nonfarm payrolls beat expectations, with unemployment falling to 4.1% and softer wage growth supporting the “soft landing” narrative. Yields rose and the yield curve flattened. Federal Reserve Chair Jerome Powell reiterated policy patience at the European Central Bank forum. Gold and oil rebounded modestly, while the dollar edged lower.

Back in the UK, BoE mortgage approvals rose to 63,030 in May - the highest since February 2024 - signalling resilient housing demand supported by rate cut expectations and rising real incomes. However, house price growth slowed, with Zoopla reporting a 1.4% rise in May and Nationwide noting a surprise 0.8% month-on-month decline in June. Despite softer prices, underlying buyer conditions remain supportive, with sales activity reaching a four-year-high.

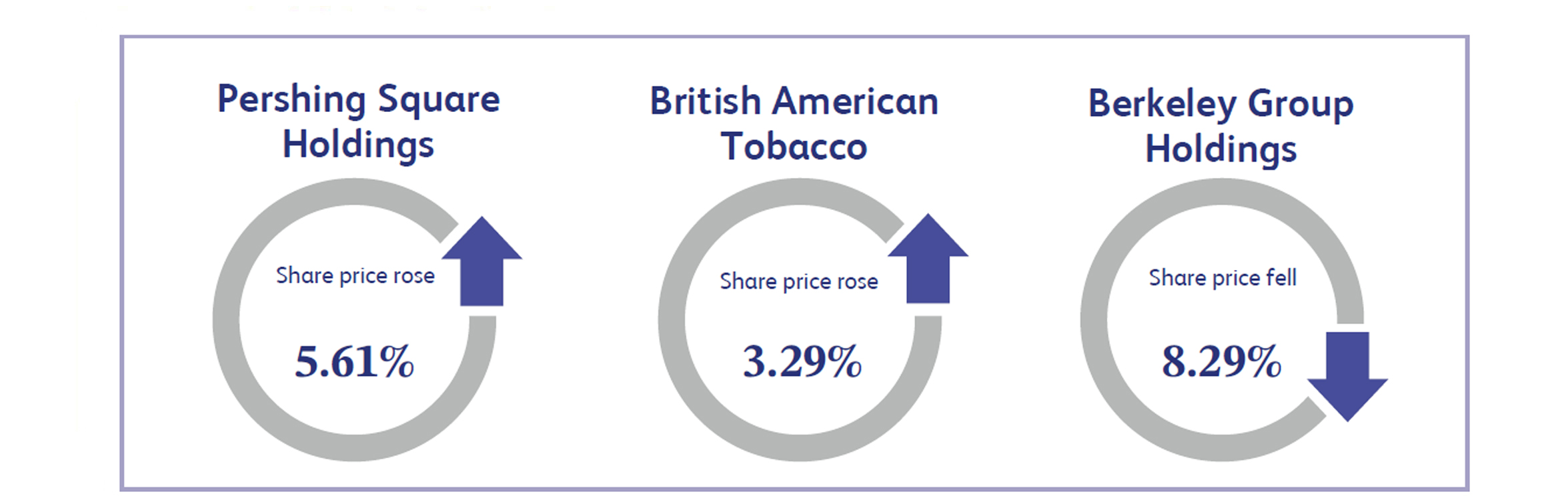

Pershing Square Holdings ("PSH") rose 5.61% last week after announcing a $200 million share buyback programme. The board mandated Jefferies International to repurchase up to 10 million shares on the London Stock Exchange, a move likely aimed at boosting shareholder value and narrowing the discount to net asset value. Buybacks typically signal management’s confidence in the company’s valuation and future prospects. As PSH is a closed-ended fund with a concentrated portfolio, this initiative likely enhanced investor sentiment, attracting renewed interest. The news helped PSH outperform broader market trends despite limited change in underlying holdings or macroeconomic developments.

British American Tobacco ("BAT") gained 3.29% last week, buoyed by two positive developments. Firstly, France introduced a new production standard for nicotine pouches, which BAT welcomed, as it creates clarity in a fast-growing segment of the market. Secondly, BAT expanded its ongoing share buyback programme by an additional £200 million, bringing the total to £1.1 billion. This move signals strong cash flow and management’s commitment to returning capital to shareholders. Together, the regulatory milestone and enhanced capital return strategy improved market confidence, lifting shares amid a broader trend of investor preference for value and income-generating stocks.

Berkeley Group Holdings fell 8.29% last week following signs of continued weakness in the UK housing market. The June Halifax House Price Index showed flat month-on-month growth, after a 0.3% fall in May, dampening sentiment towards homebuilders. Berkeley, a high-end residential developer, is particularly sensitive to changes in housing demand, and recent increases in stamp duty have created a drag on buyer activity. Despite some analysts expecting a recovery later in the year, near-term sentiment remains cautious. Investors likely reacted to fears of prolonged softness in the housing market, prompting sharp profit-taking in Berkeley shares.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.