2 April 2024

Market News

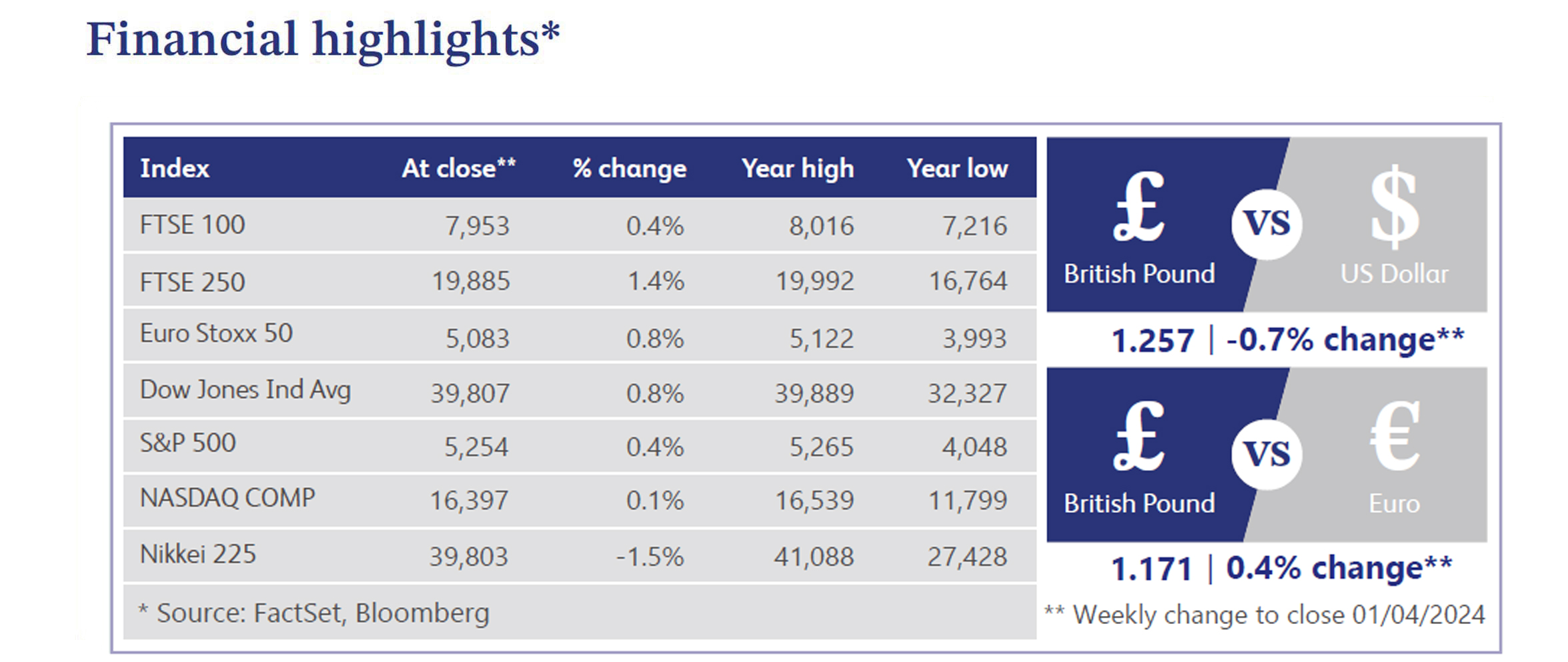

Amidst recent economic data demonstrating a challenging landscape, the UK economy finds itself navigating through uncertain waters. Official figures released by Reuters last week confirmed that the UK economy slipped into a shallow recession last year, with gross domestic product ("GDP") contracting by 0.1% in the third quarter and 0.3% in the final quarter of 2023. Although unchanged from preliminary estimates, these numbers underscore the fragile state of the economy.

The weak starting point for GDP growth in 2024 suggests that the pace of recovery may be modest, with forecasts indicating growth limited to less than 1% for the calendar year. Structural headwinds are expected to constrain growth, prompting concerns that prolonged high-interest rates could exacerbate risks to the economy.

Warnings against maintaining rates too high for too long have echoed from consultancy firm KPMG, cautioning that such a stance could hinder economic recovery. The sentiment is shared by other commentators who fear that the Bank of England's (“BOE”) cautious approach might lag behind in addressing inflation concerns, potentially falling behind the curve.

Market expectations for BOE rate cuts have intensified, with the probability of a May rate cut now standing at 20%, higher than corresponding expectations for the Federal Reserve and the European Central Bank. The recent dovish hold by the BOE and comments from Governor Andrew Bailey have contributed to this shift in sentiment. However, BOE policymakers like Catherine Mann and Jonathan Haskel have cautioned against excessive rate cut expectations, citing underlying inflation dynamics and persistent wage pressures in the UK.

In the midst of shifting rate cut expectations, mortgage lenders are adjusting their rates downwards to align with the evolving economic landscape. Natwest's reductions on remortgage deals and trackers are indicative of efforts to stimulate housing market activity amidst uncertain economic conditions. As mortgage rates trend lower, housing stocks may attract increased investor interest, bolstering market sentiment in the real estate sector.

Meanwhile, UK retail investors are displaying optimism towards the equity market, reflecting an improved macroeconomic environment. A survey by Etoro's Retail Investor Beat reveals a surge in cash allocations towards UK stocks, marking the highest level in over a year. Positive sentiment in equity markets is further supported by bullish calls for the UK outlook, with expectations of material boosts from buybacks and attractive dividends.

However, retail sales are facing challenges, with consumers turning to extreme discounting to counter subdued spending trends amidst rising inflation. Grocery price inflation has moderated but continues to impact household budgets, highlighting ongoing economic pressures.

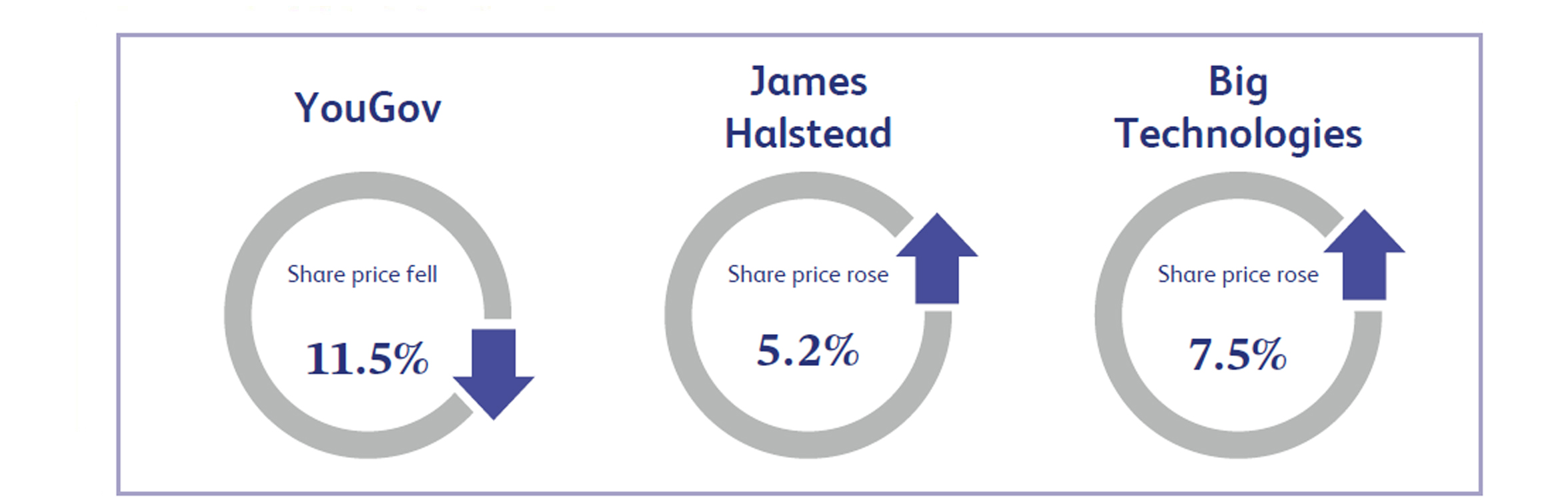

YouGov, an international online research data and analytics technology company, announced its latest results last week which saw its shares close the week approximately 11.5% lower. The company reported revenues of £143.1 million, an increase of 9% in comparison to last year’s figure alongside its operating profit increasing by 23% to £27.9 million. However, despite these positive figures, the company reported a basic earnings per share figure of 3.7 pence, a 75% decline in comparison to last year's figure of 14.7 pence. This was a significant drop which saw some negative sentiment from market participants, contributing to the share price decline.

James Halstead, a UK based company engaged in the manufacturing and distributing of commercial floor coverings, saw its share price end the week approximately 5.2% higher after the company reported its first half results for 2023. The company reported strong operating profit of £26.2 million, an increase of 13% compared to last year’s £23.1 million. The company also reported a record interim dividend of 2.50 pence per share, an increase of 11% compared to the previous year. This showed a strong set of results despite a challenging economic environment which investors viewed well.

Big Technologies, the platform which connects users with construction crews and subcontractors, reported its latest financial results last week which saw the share price close the week approximately 7.5% higher. The company reported a 10% increase in revenue to £55.2 million from £50.2 million in the previous year, alongside a strong net cash position of £85.9 million, a 29% increase when compared to last year’s £66.8 million figure. The company also announced that it was exploring value-enhancing acquisition opportunities to drive further growth as a result of its strong cash position. Investors generally viewed the results positively, resulting in the upward share price performance.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.