16 January 2024

Market News

According to the latest figures announced by the Office of National Statistics last week, the UK economy grew by 0.3% in November 2023, surpassing the expected 0.2% expansion by economists polled recently by Reuters, after contracting by 0.3% in the previous month. The services sector, buoyed by robust performances in retail, car leasing and computer games, played a pivotal role in this recovery. Strong Black Friday sales and a reduction in industrial action also contributed, alongside reduced fears of a technical recession. However, Bloomberg cautioned that the 0.3% rebound in November may not be sufficient to dispel concerns of a recession, highlighting the delicate balance between stagnation and contraction.

Analysts at Deutsche Bank suggest that lower energy bills might enable UK inflation to reach the Bank of England's (“BOE”) 2% target by April, despite recurring upside risks to services inflation, as reported by The Times. Acknowledging a historically large minimum wage rise kicking in from April, analysts anticipate headline inflation approaching the target. This aligns with recent analysis by Bloomberg Economics, reflecting rapid disinflation expectations and forecasting five rate cuts in 2024. While some argue market pricing might be too aggressive, a recent survey of Chief Financial Officers suggests continued disinflation. Output price growth among corporates is declining rapidly, with the latest reading at 5.9% for the three months to December, compared to 7.5% in August. Regarding wages, ING suggests that with vacancies falling and hiring difficulties easing, pay growth may reach 4-5% by the summer. However, BNY Mellon noted in late December that strong job openings, particularly in services, hint at "structurally compatible" wage growth. The timing of potential rate cuts by the BOE in 2024 appears contingent on services inflation and wages.

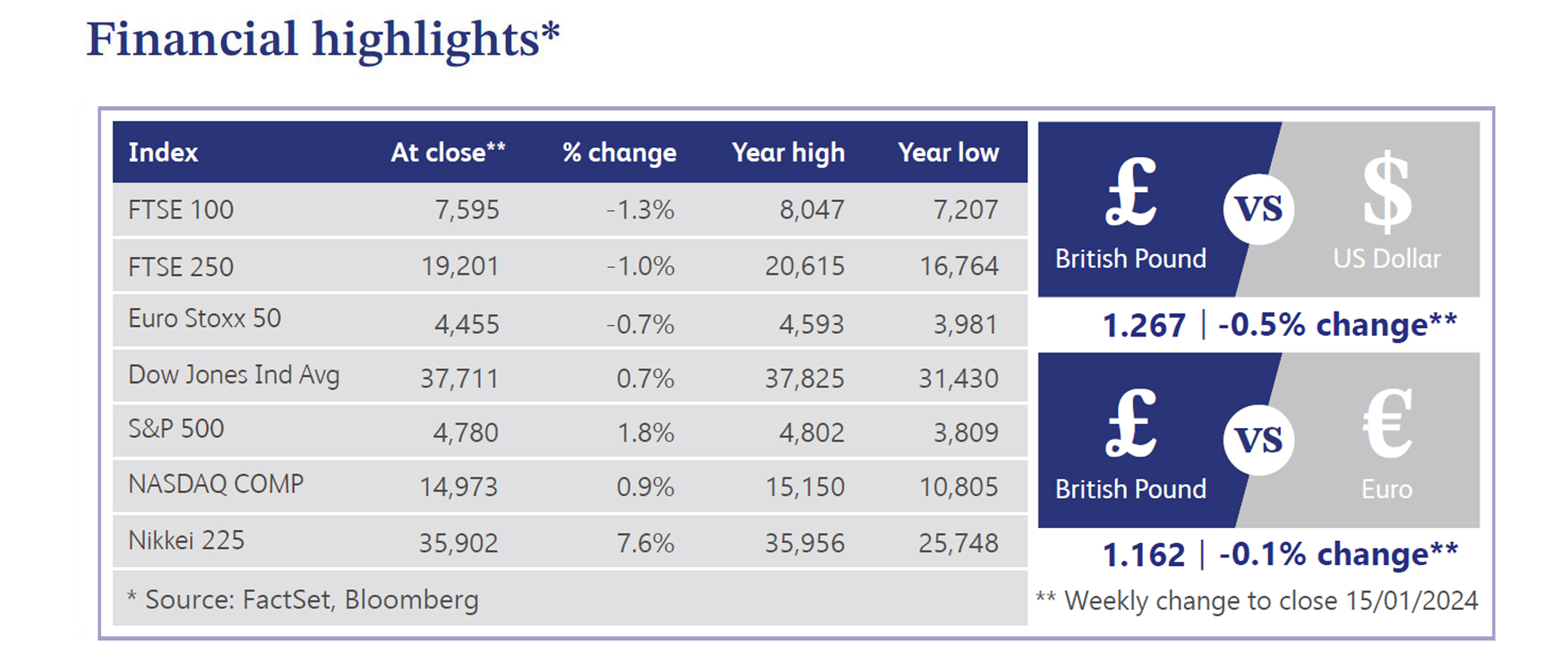

Amidst storms, strikes and ongoing disruptions, a growing number of investors are expressing optimism about UK assets. Both Goldman Sachs and Bloomberg Economics raised their growth forecasts, particularly for Sterling and UK stocks, signalling hope after a year marked by recession concerns. However, UK-focused equity funds experienced their third consecutive year of outflows, with Reuters citing Calastone data showing £8 billion withdrawn in 2023. This trend reflects the UK stock market's underperformance compared to its US and European counterparts, struggling to attract major initial public offerings.

The housing market is witnessing a significant development as major UK mortgage lenders, including Barclays and Santander, engage in a price war by reducing rates to below 4%, according to The Times. This move aims to benefit homeowners, with Santander offering some of its five-year fixed-rate deals under 4%, aligning with other leading banks. This price competition follows Barclays' reduction of up to 0.5 percentage points on its mortgage range, with its most competitive two-year fixed rate now standing at 4.17%. The mortgage rate cuts are a response to the intensifying competition among banks, providing a favourable environment for property purchasers.

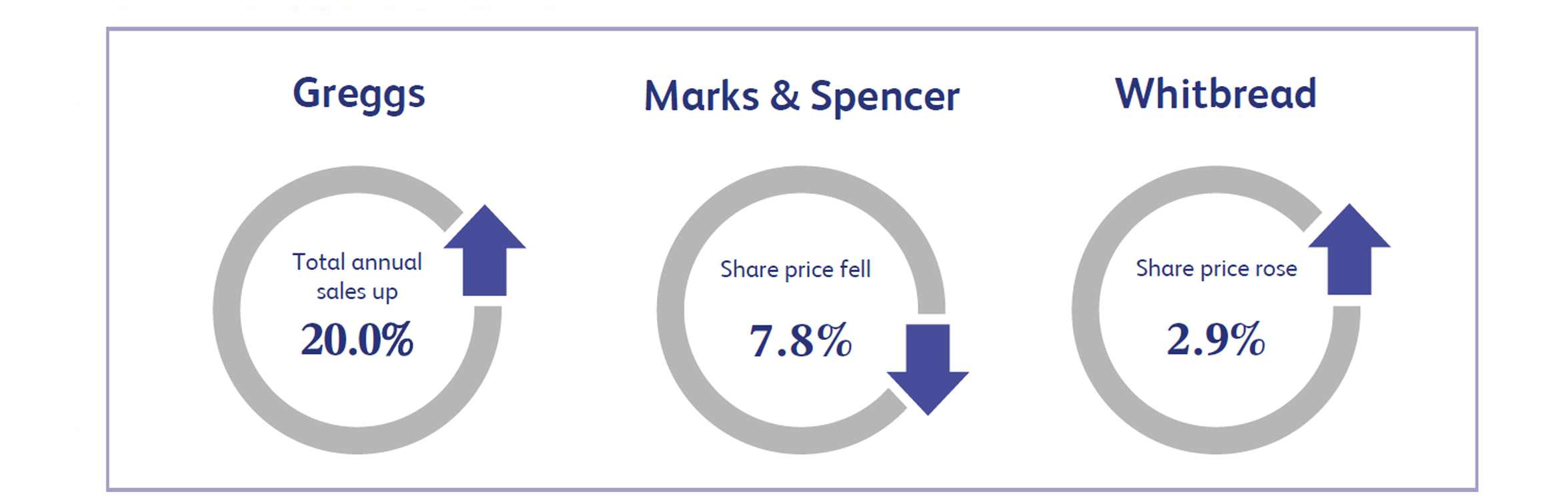

Greggs, the UK high street bakery chain, saw its share price increase by approximately 2.3% last week after the company announced its fourth quarter update for 2023. The company reported that total sales for the 2023 financial year increased by 20% to £1.8 billion, from £1.5 billion in the previous year. The company also announced that it had enjoyed good progress in the development of its supply chain capacity, supporting its growth plans. This helped the company to a record 220 new shop openings in the year, with 33 closures and 42 relocations, resulting in 145 net new shop openings and 2,473 shops trading at the end of the year.

Marks & Spencer announced its third quarter trading update last week which resulted in the share price taking a tumble, closing the week approximately 7.8% lower. The company announced food sales showing 9.9% like-for-like growth alongside clothing and home sales showing 4.8% like-for-like growth. These results were largely better than expectations, representing a strong Christmas period. However, a cautious note on the outlook due to factors such as uncertainty surrounding economic growth, geopolitical risks and cost increases contributed to a sell-off by investors.

Whitbread, the UK based hospitality business, saw an approximate 2.9% share price increase last week after the company reported its third quarter update. The company announced that total accommodation sales increased by 11% during the period, with strong demand in both London and the regions. The company also announced a £300 million share buy-back alongside growth in its German-based operations.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.