19 December 2023

Market News

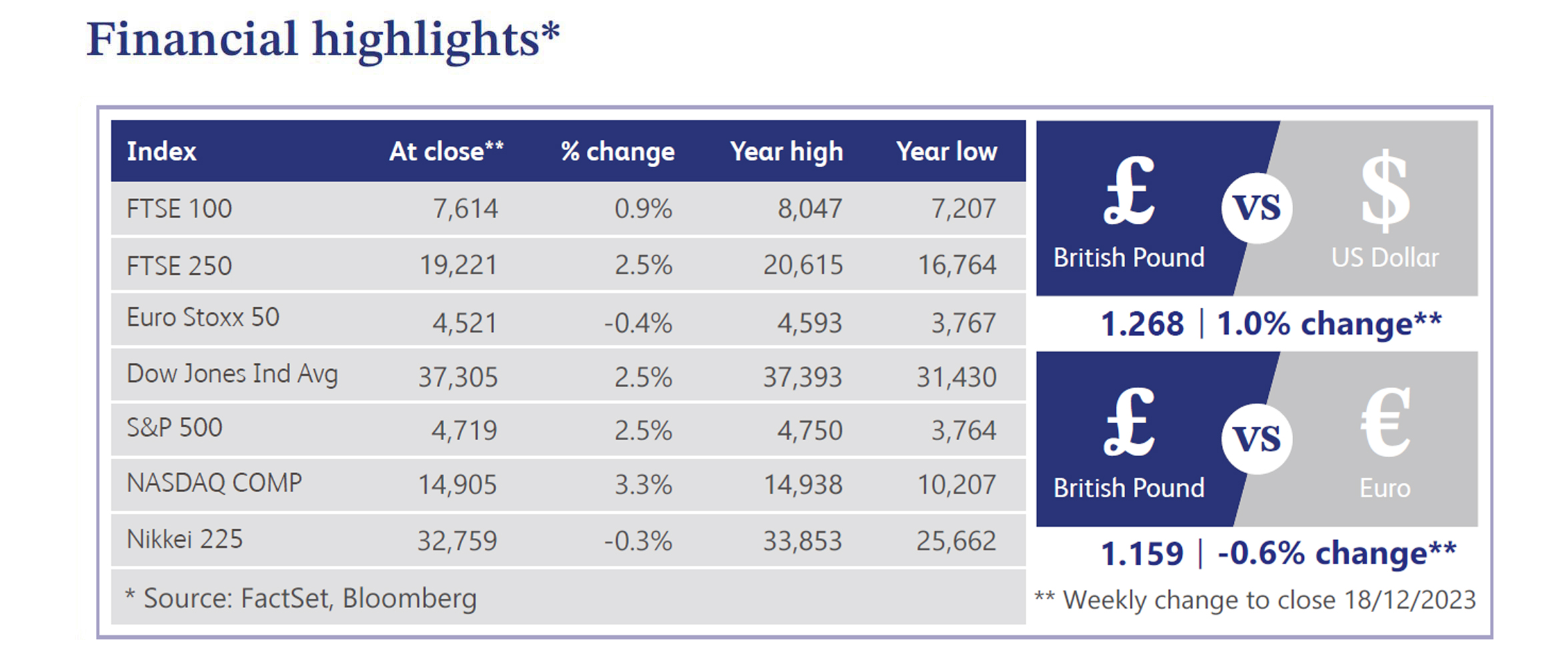

Last week saw the Bank of England ("BOE") stand firm on its key rate, leaving interest rates unchanged at 5.25% and dismissing talks of imminent rate cuts, a day after the Federal Reserve signalled its intention to cut rates in 2024. BOE Governor Andrew Bailey emphasised the ongoing fight against inflation, challenging investors who had increasingly bet on rate cuts. Despite BOE warnings, traders remained unfazed, forecasting interest rates of 4% by the end of the next year, as reported by The Times.

Contrary to market expectations, The Times also reported that the Confederation of British Industry (“CBI”) predicts that the BOE will not cut interest rates until 2026 due to persistently high inflation. The CBI outlook suggests that the base rate will stay at 5.25% for at least two more years, impacting consumer spending and business investment. The CBI's growth forecast of 0.8% in the UK for the coming year underscores concerns about the prolonged impact of elevated interest rates on the economy.

Goldman Sachs also adjusted its BOE policy outlook, expecting a faster pace of rate reductions. The bank foresees the first rate cut of 0.25% in August 2024, with subsequent decreases at each policy meeting until reaching 3% in mid-2025. This accelerated pace, compared to previous expectations, aligns with historical rate-cutting cycles, updated European Central Bank forecasts and a quicker decline in inflation. The shift in Goldman Sachs' outlook adds complexity to the evolving narrative on central bank policies.

October's monthly activity data revealed a deeper-than-expected contraction in the UK's gross domestic product (“GDP”), down 0.3%, further indicating economic struggles into the fourth quarter. The Office for National Statistics (“ONS”) highlighted weakness in the services sector, production and construction, with the full impact of BOE tightening yet to be felt. Following the disappointing data, investors increased bets on BOE rate cuts, with money markets pricing in approximately 1% worth of rate cuts in 2024.

Amid economic challenges, UK manufacturing showed signs of resilience. Make UK, formerly the Engineering Employers’ Federation, reported that factories raised output at a rate three times the growth in orders, with the upturn possibly attributed to export expectations. However, the overall economic scenario remains mixed, as evidenced by the ONS's labour market data for November. The claimant count increased, payrolled employees dipped and estimated vacancies fell, indicating a potential softening in the labour market.

The UK property market witnessed sellers cutting asking prices in December, according to Rightmove, with an unusually large 1.9% drop in prices. Despite the seasonal nature of price declines in December, this drop surpassed the 20-year average. Zoopla reported a slowdown in the pace of rent growth, especially in London, where affordability pressures are cooling demand. The UK's largest mortgage lender, Halifax, remains cautious, expecting house prices to fall between 2% and 4% next year.

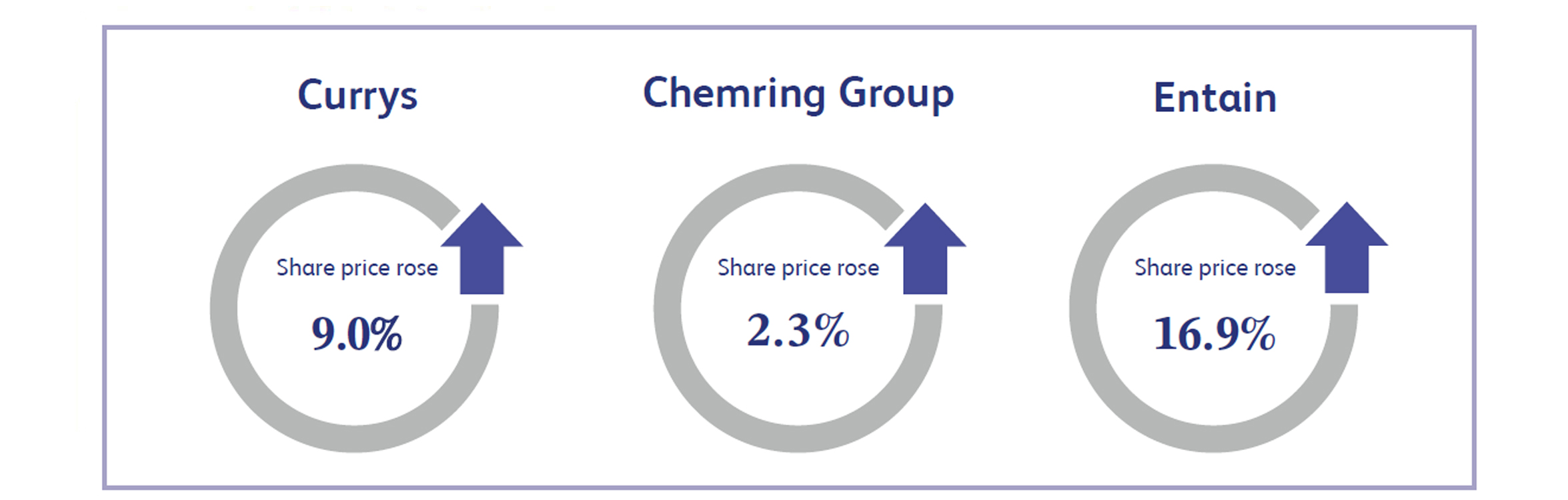

Currys, the electrical retailer, saw its share price increase by approximately 9% last week after announcing its half-year results. The company reported that group adjusted earnings before interest and tax increased 7% year-on-year. Currys also announced that it was on track to meet its £300 million cost savings target for the year.

Chemring Group, the technology solutions company, reported its full year results last week which showed a record order intake of £756 million with growth across both of its key segments. The closing order book was also at its highest level in over a decade, at over £922 million. Chemring also outlined an ambitious £120 million investment programme for its energetics division which demonstrates the ambition of the management team. Overall, investors appeared reasonably pleased with the strong set of results, with the shares closing the week approximately 2.3% higher.

Entain, the international sports-betting and gaming company operating both online and in the retail sector, saw its shares increase by approximately 16.9% last week after the company announced its Chief Executive Officer is to step down with immediate effect. It was also announced that Corvex Management has acquired approximately 4.4% of the outstanding shares. Corvex believes that Entain is at a critical stage and could benefit from the expertise it can provide.

The Market Commentary will return for 2024 on 9th January. Merry Christmas and Happy New Year!

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.