28 November 2023

Market News

As per a City A.M. poll last week, economists project Bank of England (“BoE”) interest rate cuts between May and August next year, contrasting with market expectations of a move from March. BoE policymakers remain cautious about high wage growth and persistent inflation concerns and view the ongoing Gaza conflict as a significant risk to inflation targets. The potential for an earlier rate cut hinges on economic slowing, influenced by the impact of prior rate tightening.

BoE Governor, Andrew Bailey cautioned against premature rate cut discussions, emphasising the early stage in addressing inflation and the potential for increased borrowing costs. The threat of rising food and energy prices remains a concern. The BoE's stance aligns with the consensus for a first rate cut next summer unless a substantial economic slowdown occurs. JP Morgan's projection of the first rate cut in the fourth quarter of 2024 adds complexity to the debate, anticipating risks of a potential recession by late 2024.

Figures announced last week showed that in October, UK public sector borrowing increased to £14.9 billion, surpassing forecasts for £13.7 billion and representing the second-highest October borrowing on record. Total government spending rose by 7.7% to £99.8 billion, driven by higher benefit costs. Interest payments on government debt reached a record £7.5 billion, highlighting fiscal challenges. Chancellor Jeremy Hunt’s Autumn Statement included a larger-than-expected cut in National Insurance for employees to 10% from 12%, alongside increases in the state pension by 8.5% and universal credit by 6.7%. Despite these measures, the percentage of income being paid in tax is set to rise to the highest level in 70 years.

The latest survey by XpertHR, a leading human resource solutions provider, reveals that pay awards in the three months to October rose to 6% from a previous 5.5%, matching series highs. Public sector median pay rose to 6.5% compared to 4% a year ago, the highest since 1991, and above the private sector median. Official wage growth data in the week prior to last, showed a slight easing but still higher than consensus expectations as employers have tried to help employees manage cost of living pressures by offering one-off bonuses and pay rises. However, concerns linger about the potential for wage inflation to fall more rapidly as the economy slows and price pressures ease.

Deputy BoE Governor, Dave Ramsden, noted that consumers are currently facing the peak impact of high interest rates, with the 15-year high rates delivering the most significant impact on growth in the last three months of the year. BoE research highlights that a fall in UK house prices could lead to higher mortgage rates, even without further monetary policy tightening. The analysis suggests potential economic impact if house prices fall by 10%, emphasising the dependence on the rate outlook and labour market developments for the housing market in 2024.

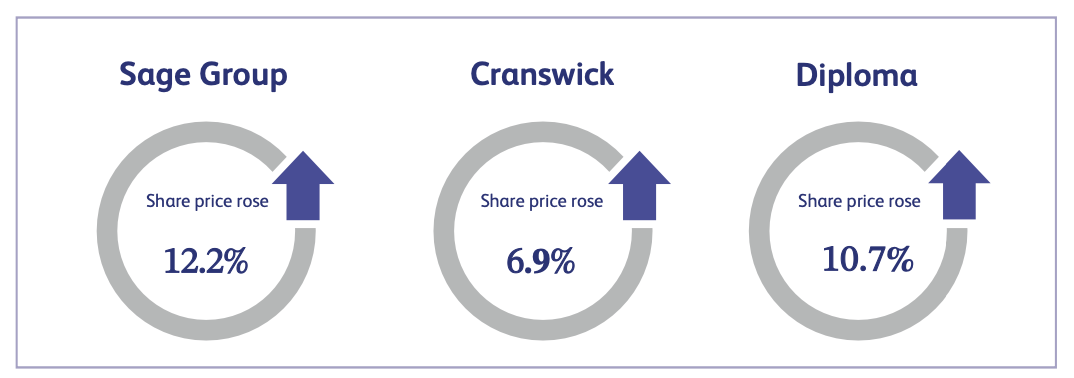

Sage Group, the business management software solutions company, announced its full year results last week which contributed significantly to the share price closing the week approximately 12.2% higher. The company reported underlying earnings per share of 32.3 pence, an increase of 22% compared to last year's figure of 26.4 pence. The results also demonstrated a 12% increase in underlying recurring revenue to approximately £2.1 billion. Analysts viewed these as a strong set of results and were also buoyed by the announcement of a £350 million share buyback to be completed by April 2024.

Cranswick, the UK food product manufacturer and supplier, saw its share price increase by approximately 6.9% last week after announcing its first half results. The company reported revenue of approximately £1.25 billion, a 12% increase compared to last year's figure of £1.12 billion. The announcement also stated that despite the company remaining cautious about market conditions and the wider economic and geopolitical conditions, the outlook for the current financial year is expected to be at the upper end of market consensus.

Diploma, the supplier of specialised technical products and services, announced its full year results last week which contributed to its share price surging by approximately 10.7%. The announcement detailed revenue of £1.2 billion, a 19% increase compared to last year’s figure of £1.01 billion. The company remains focused on executing its strategy of building high quality, scalable businesses for organic growth and remains confident in its ability to deliver long-term growth at sustainably high margins.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.