18 July 2023

The economic outlook remained the primary focus in the UK last week as persistent high inflation and rising interest rates continued to be at the forefront of investors' minds. Market participants are still pricing in a peak interest rate of 6.5% in the UK, implying a further 1.5% of tightening. This is as a result of the Bank of England’s (“BoE”) larger than expected 0.5% increase in June, due to persistent high inflation, which has led the BoE to reiterate its commitment to reducing inflation towards its 2% target. The question now is whether the BoE should increase its inflation target in order to benefit the UK economy. However, BoE Governor Andrew Bailey responded that any adjustments could damage the bank’s credibility and unpick expectations. Bailey also stated that the BoE can be flexible over the time it takes to bring inflation back down to the current target, but this should not be confused with people thinking the BoE not pursuing this goal. Bailey also commented that he expects inflation to fall markedly this year, largely due to energy prices, but warned that labour market tightness is not consistent with the inflation target.

The labour market has been one of the main contributors to persistently high inflation. An updated publication was released early last week from KPMG and the Recruitment and Employment Confederation which indicated a potential cooling in the UK job market. The survey of recruiters indicated that pay pressures are easing, as starting salaries for permanent and temporary staff are at the weakest level since April 2021. However official UK data was also announced which suggested an ongoing contraction in the labour market. The latest unemployment rate, covering the period March to May 2023, came in at 4% against expectations of 3.8%. This is likely to reflect school leavers joining the labour market. Wage growth remained at elevated levels with average earnings excluding bonuses at 7.3% in May versus estimates of 7.1%. Earnings including bonuses came in at 6.9% against a forecast of 6.8%. These figures are likely to increase the risk of the market pricing in another 0.5% rate hike in August by the BoE.

Another key topic recently has been the results of the BoE's Financial Stability Report. The report states that UK banks remain strong enough to support households and firms, even if economic conditions are worse than the BoE expects. The results stated that household spending on mortgage payments is widely expected to rise, but should remain below peak levels experienced in the global financial crisis and early 1990s. The strength of the UK banks should therefore ensure that customers facing difficulties will get support, resulting in lower defaults than in the past. This is expected to be similar with companies, however higher rates are likely to hit smaller and highly indebted businesses.

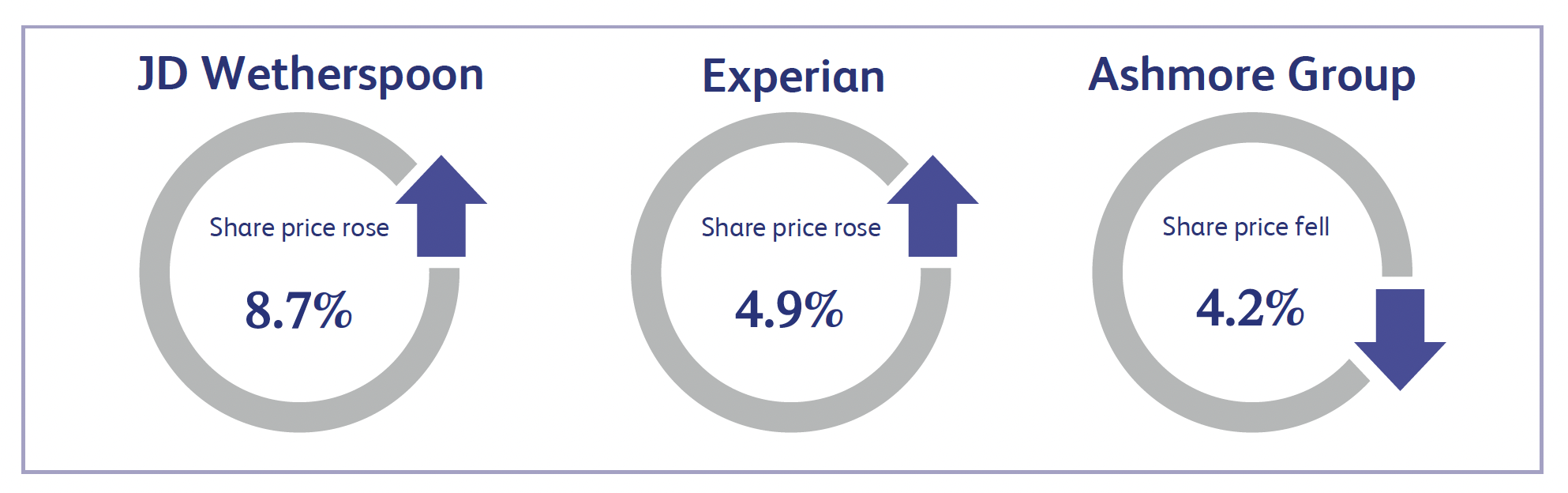

Last week saw the shares of JD Wetherspoon, the owner and operator of pubs throughout the UK and Ireland, increase by approximately 8.7% after announcing a trading update. The update demonstrated that trading was in line with market expectations and in the last 10 weeks like-for-like sales were 11% higher than 2019 levels. The company also announced a small improvement in expected utility costs, resulting in a one-off uplift to the company’s estimates for 2024.

Experian, the global information services company, delivered good growth in the first quarter with organic revenue increasing 4.9%. The company also announced increased revenue from new product innovation. The company confirmed its guidance and appears to be performing consistently well. Experian delivered good growth in the first quarter with organic revenue growth increasing 5%. The company also announced good revenue growth from new product innovation; an area where it has consistently excelled over several years.

Ashmore Group, the specialist emerging markets investment manager, saw a decline in its share price of approximately 4.2% last week. This came after announcing its fourth quarter assets under management (“AUM”) statement which was below market expectations. The company’s AUM was announced at $55.9 billion which was approximately 2% worse than expectations. This was driven by higher-than-expected net outflows of $2.6 billion. Management stated this was primarily as a result of top-down asset allocation decisions by institutional clients in the external debt theme, which saw $1.6 billion of withdrawals in the three months to the end of June 2023 - a decline of 13% over the period.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.