20 May 2025

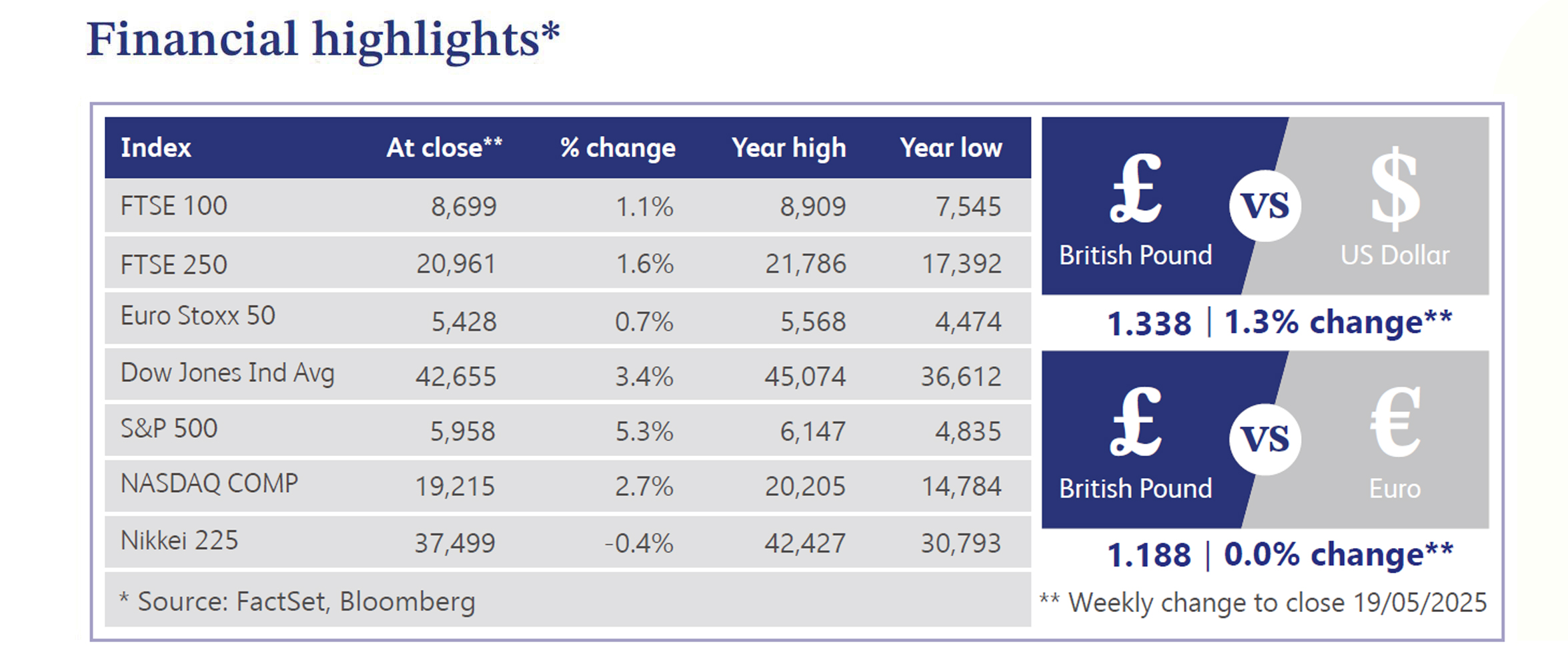

Global equity markets delivered strong gains last week, with the United States (“US”) leading the advance following encouraging developments in trade negotiations and solid earnings results. The S&P 500 and Nasdaq moved higher after the US and China reached an agreement to ease trade tensions during talks held in Switzerland. The agreement involves a 90-day suspension of most newly imposed tariffs. As part of the deal, US tariffs on Chinese goods will drop from 145% to 30%, while Chinese tariffs on US imports will fall from 125% to 10%. Markets responded positively to the prospect of a more constructive trade relationship between the world’s two largest economies. Additional optimism stemmed from corporate activity, including confirmation that Saudi Arabia will be permitted to purchase advanced semiconductor chips from major US technology firms. Meanwhile, Qatar Airways placed a record aircraft order worth $96 billion from Boeing. These announcements further boosted sentiment, helping major indices recover above their early April levels by the end of the week.

US macroeconomic data was mixed. The University of Michigan’s Index of Consumer Sentiment declined for a fifth consecutive month in May to 50.8, reflecting ongoing consumer caution. Retail sales increased by only 0.1% in April, a sharp slowdown from March’s 1.7% rise, suggesting that consumers brought forward purchases ahead of anticipated tariff hikes. Meanwhile, the Consumer Price Index (“CPI”) rose 2.3% year-on-year in April, slightly below market expectations and marking the slowest annual inflation rate since early 2021. With 92% of first quarter earnings reported, 78% of S&P 500 companies have exceeded earnings expectations, and current earnings growth stands at 13.6% year-on-year, well above the 7.1% anticipated at the end of March.

In the United Kingdom (“UK”), equity markets continued to climb, supported by momentum from the recent limited trade agreement with the US and stronger than expected Gross Domestic Product (“GDP”) data. The UK economy expanded by 0.7% in the first quarter, ahead of the Bank of England’s (“BoE”) forecast of 0.1%. Growth was driven by the services sector and manufacturing, particularly among exporters to the US. However, the BoE anticipates a slowdown, projecting second quarter GDP growth at just 0.1%, with full-year forecasts at 1% for 2025 and 1.25% for 2026. Retail activity was also strong, with industry data showing a 7% year-on-year increase in the value of retail sales in April, supported by warmer weather. Wage growth moderated to 5.6% in the three months to March, still above the BoE’s inflation target, as employers cut jobs in anticipation of higher payroll taxes and increases to the minimum wage. Labour market data showed emerging signs of weakness, with the unemployment rate edging up to 4.5% from 4.4%, according to the Office for National Statistics.

European markets posted their fifth consecutive weekly gain. The Stoxx 600 reached its highest level since the onset of the tariff disputes, while Germany’s DAX recorded a fresh record high. Revised Eurozone GDP figures showed growth of 0.3% quarter on quarter, supported by employment growth of 0.3% reinforcing optimism about the region’s resilience.

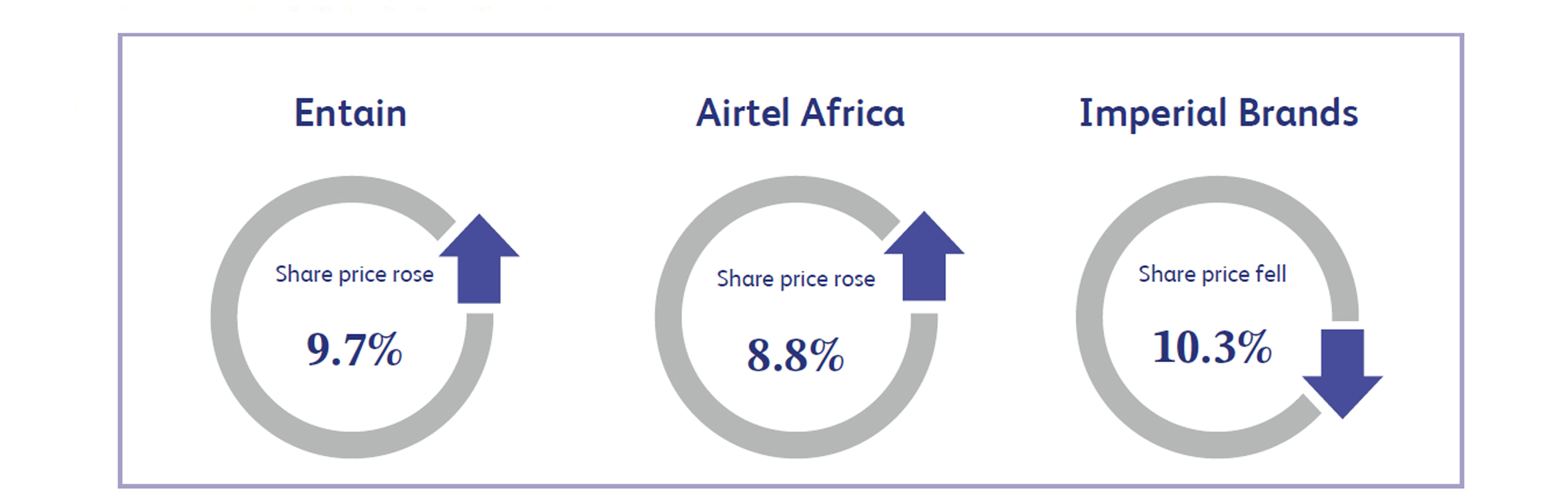

Entain saw its share price rise by 9.7% last week, following a strong Quarter 1 (“Q1”) 2025 trading update. Group Net Gaming Revenue (“NGR”) was up 9% year-on-year, with online NGR, including Entain’s 50% stake in BetMGM, increasing by 11%. The UK and Ireland online segment stood out with a 23% rise. With inflation easing and wage growth remaining solid, UK consumers are proving resilient and confidence in spending remains strong. The appointment of Stella David as CEO has brought leadership continuity, helping to reinforce investor confidence in the company’s strategic direction.

Airtel Africa’s shares climbed 8.8% over the week, reaching a new 52-week high. In Q1 2025, the company delivered revenue growth of 21.3% in constant currency to $1.27 billion, driven by a 35% increase in Nigeria and 23% in East Africa. Reported revenue growth in US dollars was 2.5%, reflecting ongoing currency headwinds. Nevertheless, the business continues to show strong momentum despite challenging macroeconomic conditions. Its core segments, Mobile Services and Money Services, remain the key drivers, supported by efforts to grow the customer base and strengthen digital offerings.

Imperial Brands fell 10.3% last week after the unexpected news that CEO Stefan Bomhard will be stepping down. His tenure focused on core markets and returning value to shareholders, but the sudden change in leadership unsettled the market. CFO Lukas Paravicini has been appointed as his successor to ensure continuity. Although the company reported a modest profit increase in its half-year results, investor sentiment has been dented by concerns around the transition and Imperial’s positioning in next-generation products.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.