13 January 2026

Last week UK markets rallied as investors flocked to gilts, putting them on track for their best week since October, with benchmark yields falling more than 0.1% to nearly 4.4%. This fixed income resurgence was underpinned by a government pivot away from long-term borrowing and intensifying bets on an April rate cut from the Bank of England (“BoE”). Economic data supported the dovish outlook as the labour market showed signs of significant strain; potential redundancies surged to over 33,000 in late 2025, the highest level in nearly three years, prompting strategists to forecast that deteriorating macro conditions will force policymakers to ease rates sooner than previously expected.

On the fiscal front, Chancellor Rachel Reeves faces renewed pressure to adjust spending plans, reportedly preparing a £300 million bailout for pubs to mitigate the impact of rising business rates. Simultaneously, Prime Minister Keir Starmer has been warned of a £28 billion funding gap in the Ministry of Defence, complicating upcoming investment strategies. In regulatory news, the government clarified that its pursuit of closer European Union (“EU”) ties will explicitly exclude the City of London to preserve financial independence, even as a House of Lords committee criticised the Treasury for overlooking systemic risks within the booming private credit market.

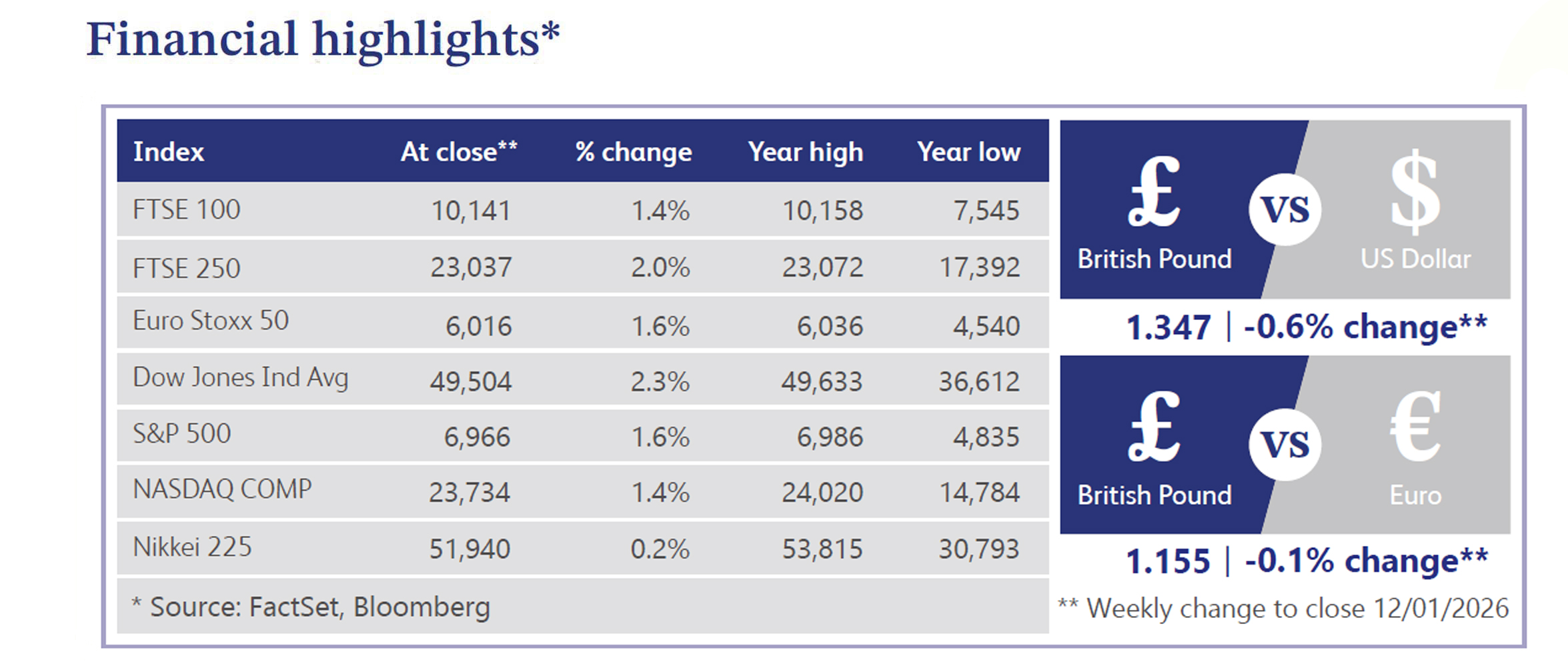

In equities, the FTSE 100 index rose 1.4% to close at 10,141, extending its year-to-date gain to 2.11%. This performance was largely underpinned by a strong rally across the mining sector, driven by Glencore shares surging 8.5% after the company confirmed renewed merger discussions with Rio Tinto. However, this positive momentum was partially offset by a notable decline in the supermarket sector, as Sainsbury shares fell by 6% following a disappointing quarterly trading update. Concurrently, the value of Sterling softened against the US dollar, trading down to $1.347.

Across the Atlantic, US equities posted a strong start to the year, with the Dow, S&P 500 and Russell 2000 all hitting fresh record highs. The S&P 500 gained 1.6%, led by a pro-cyclical rotation that saw the equal-weight index outperform its cap-weighted counterpart. Big tech was mixed with Amazon (+9.2%) and Alphabet (+4.3%) gaining, but Apple falling 4.3% due to funding pressure. An improved unemployment rate (4.4%) reinforced expectations for the Federal Reserve (“Fed”) to hold rates. Other market movements included falling long-end Treasury yields, a stronger dollar (+0.7%), and a gold rebound (+3.9%). Investors largely ignored geopolitical developments in Venezuela and Ukraine, focusing instead on upcoming fiscal stimulus and corporate earnings.

UK housing sentiment weakened in late 2025, evidenced by a surprising 0.6% December house price fall, dropping annual growth to 0.3%. Despite near pre-Covid activity and improved affordability, structural issues, like a council planner shortage, hinder the 1.5 million homes target. Lenders project modest 1–3% price growth for 2026, driven by lower mortgage rates but threatened by job insecurity and slowing wage growth.

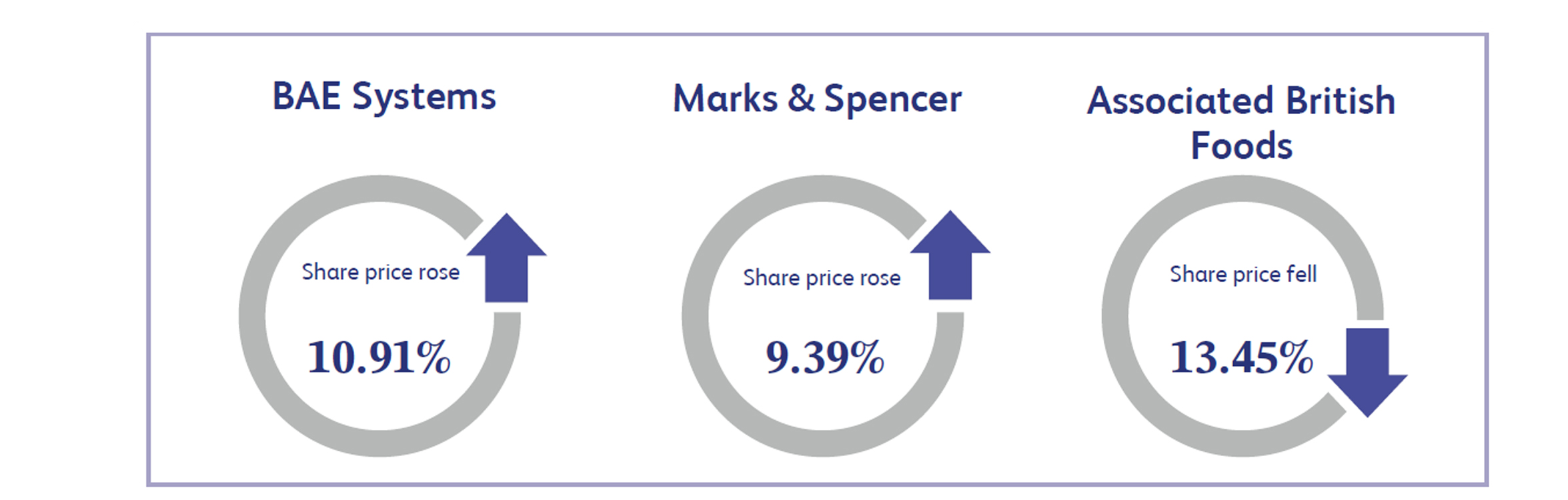

BAE Systems, the transnational arms, security and aerospace specialist was the best performer last week, gaining 10.91%. The company's shares advanced, driven by investor confidence in a structural "supercycle" of global defence spending. Industry analysts praised the firm's solidified pipeline of long-term government contracts and its pivotal role in replenishing national ammunition stockpiles, positioning it as a prime beneficiary of the elevated geopolitical tension expected in 2026. However, the rally’s momentum was tempered by persistent industry-wide worries over supply chain constraints. This remains the most significant obstacle preventing the seamless conversion of its record order backlog into reliable free cash flow.

Marks & Spencer, the iconic high street retailer focused on premium food and apparel, was a standout performer, gaining 9.39%. The company's shares advanced, driven by investor confidence in the successful execution of its "Reshape for Growth" strategy. Industry analysts praised the firm's revitalised clothing lines and resilient food market share, positioning it as a key winner from the anticipated recovery in discretionary spending in 2026. However, the rally's momentum was softened by ongoing concerns over the rising cost of doing business. This remains the biggest hurdle to the full conversion of higher sales volumes into expanded operating margins.

Associated British Foods, a diversified international food, ingredients and retail group, trailed the FTSE 100, plunging 13.45%. The company's shares retreated, driven by investor alarm over a deteriorating outlook for its Primark retail division. Industry analysts criticised the firm's exposure to volatile commodity costs and softening high street footfall, positioning it as a notable casualty of the consumer spending squeeze expected in 2026. The sell-off was further exacerbated by persistent industry-wide worries over rising freight rates. This remains the most significant obstacle preventing the recovery of the group's operating margins.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority (FRN:226344) and is a member of the London Stock Exchange. Registered office: 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.