4 July 2023

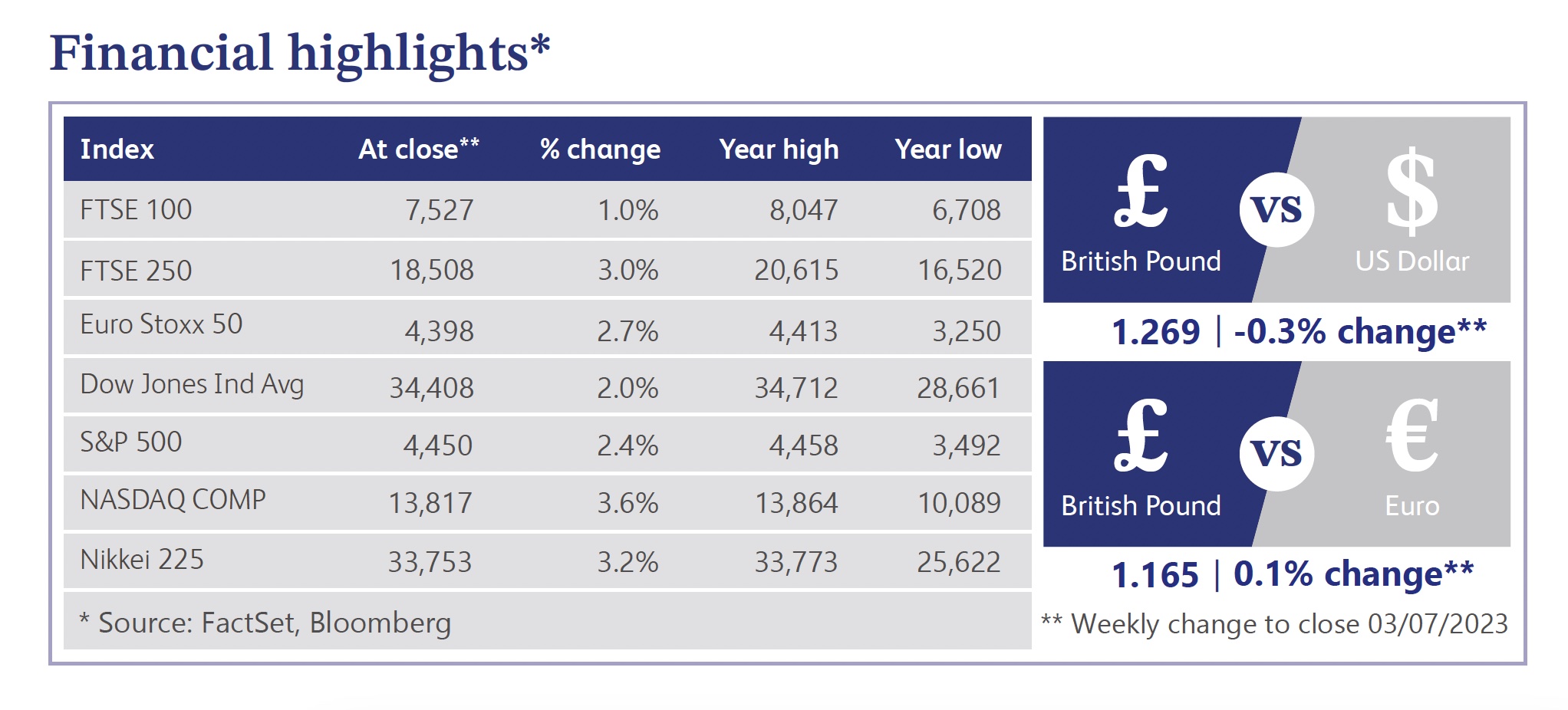

Last week was relatively quiet in terms of economic data as discussions were largely focussed on UK inflation figures and Bank of England (“BoE”) interest rates announced the previous week. A Reuters poll of economists expected the BoE to make two additional rate increases of 0.25% in August and September due to high inflation. This would take the base rate to 5.5% by the end of the third quarter. The BoE remains under pressure to continue raising interest rates as core inflation continues to accelerate, but there are increasing fears of running the risk of overtightening. Economists have warned that the cost of bringing UK inflation under control is increasing the likelihood of a 2024 recession. However, the BoE Governor, Andrew Bailey, suggested that policymakers might be forced to keep rates at peak levels for an extended period. Bailey also expected notable jumps to headline inflation further down the line, with core inflation remaining much stickier due to the UK’s compressed labour market. Markets are therefore pricing a peak rate of 6.25% by February 2024.

However, there were signs of progress towards reducing inflation as British Retail Consortium (“BRC”) shop price data eased in June for the second month. In June, prices in supermarkets and retail chains were up 8.4% from the same period last year, following a year-on-year reading of 9% in May - the highest reading since BRC records began in 2005. Food prices also increased at a slower pace for a second month. June’s reading showed a 14.6% increase versus a 15.4% in May and a record high of 15.7% in April. This suggests that the UK may be past the peak of prices, providing that global supply chain costs continue to fall.

The housing market also remained in focus as rising interest rates continue to have a significant impact on the market. The cost of a two-year fixed rate mortgage increased to 6.23% on Monday last week, the highest rate since last November. Meanwhile, the average cost of a five-year fixed rate mortgage deal rose to 5.86%. That being said, BoE data showed that mortgage approvals in May unexpectedly increased to 50,500 from 49,000 the previous month. Approvals for remortgaging also saw a rise to 33,600 from 32,600 during the same period. Figures also showed that the value of total mortgage lending fell for a second month running, which is the first back-to-back decrease since records began in 1986. Zoopla analysis showed that a rise in mortgage rates from 4% to 5% with a 75% loan-to-value mortgage reduced buying power by 11%, and this figure increased to 20% with rates rising to 6%. The outlook for the housing market continues to look increasingly negative, but it seems reasonably unlikely to feed directly into prices. Buyers can offset reduced buying power by either injecting more equity into purchases and/or taking longer mortgage terms. However, these options won’t be available to everyone. The more rates increase, the greater the impact on the number of buyers in the market.

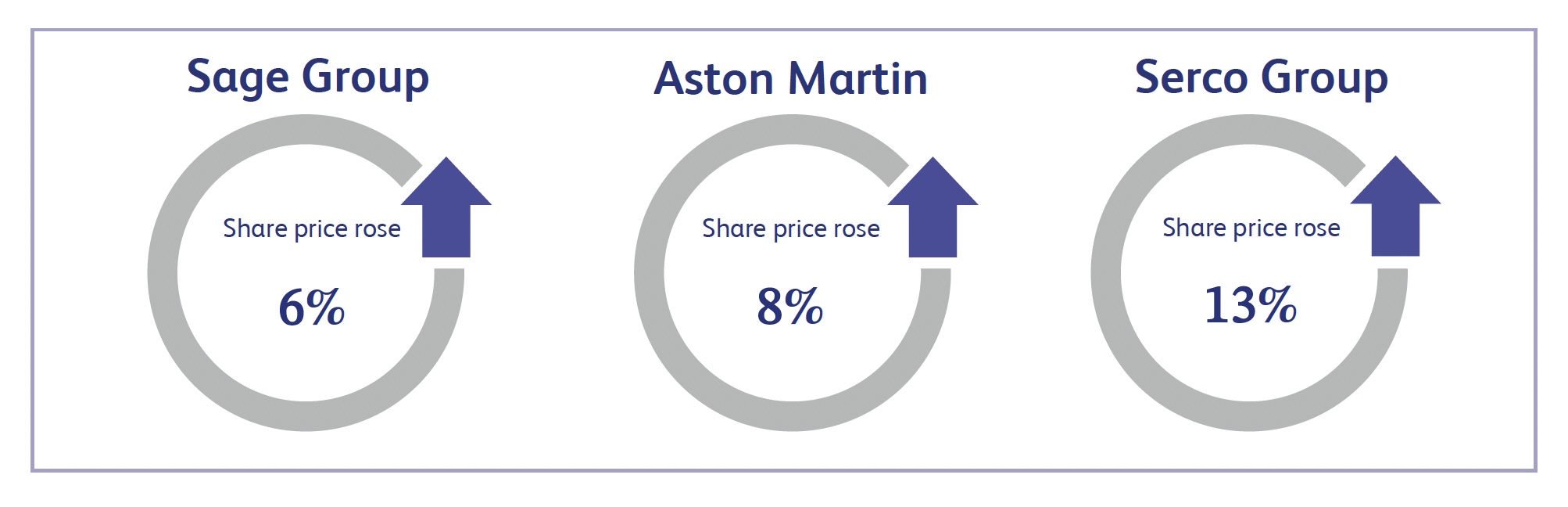

Sage Group, the cloud-based business management solution company, saw JP Morgan analysts upgrade the stock to overweight from neutral. This resulted in its share price increasing by approximately 6% last week. The company is expected to deliver sustainable double-digit organic revenue growth until 2025. JP Morgan believes there is room for further revenue growth between 2026 and 2030 with the company having a strong track record and a high free cash flow conversion.

Aston Martin, the UK based manufacturer of luxury cars, saw its shares surge approximately 8% last week. This was as a result of Aston Martin entering the electric vehicle market after signing a strategic agreement with US based Lucid Group. Aston Martin will issue about 28.4 million new ordinary shares alongside making phased cash payments of approximately $232 million. Lucid Group will also become a 3.7% shareholder in Aston Martin. This agreement will also complement the bespoke development of a single battery electric vehicle platform by Aston Martin. This platform will be utilised across its future electrified product portfolio. The company said it was on track to achieve its objectives of post adjusted profits of £500 million and revenue of £2 billion by 2025. Aston Martin issued new mid-term financial targets for 2027/28 of £2.5 billion in revenue and adjusted core earnings of £800 million.

Serco Group, a UK based provider of public services, issued a trading update last week which saw its share price increase approximately 13%. The company announced that it expected full-year underlying trading profits of around £245 million. This was 3% higher than 2022 and a 4% upgrade to prior guidance. This largely came from increased demand from the British government which more than offset a fall in sales experienced as a result of the Covid pandemic.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.