20 February 2024

Market News

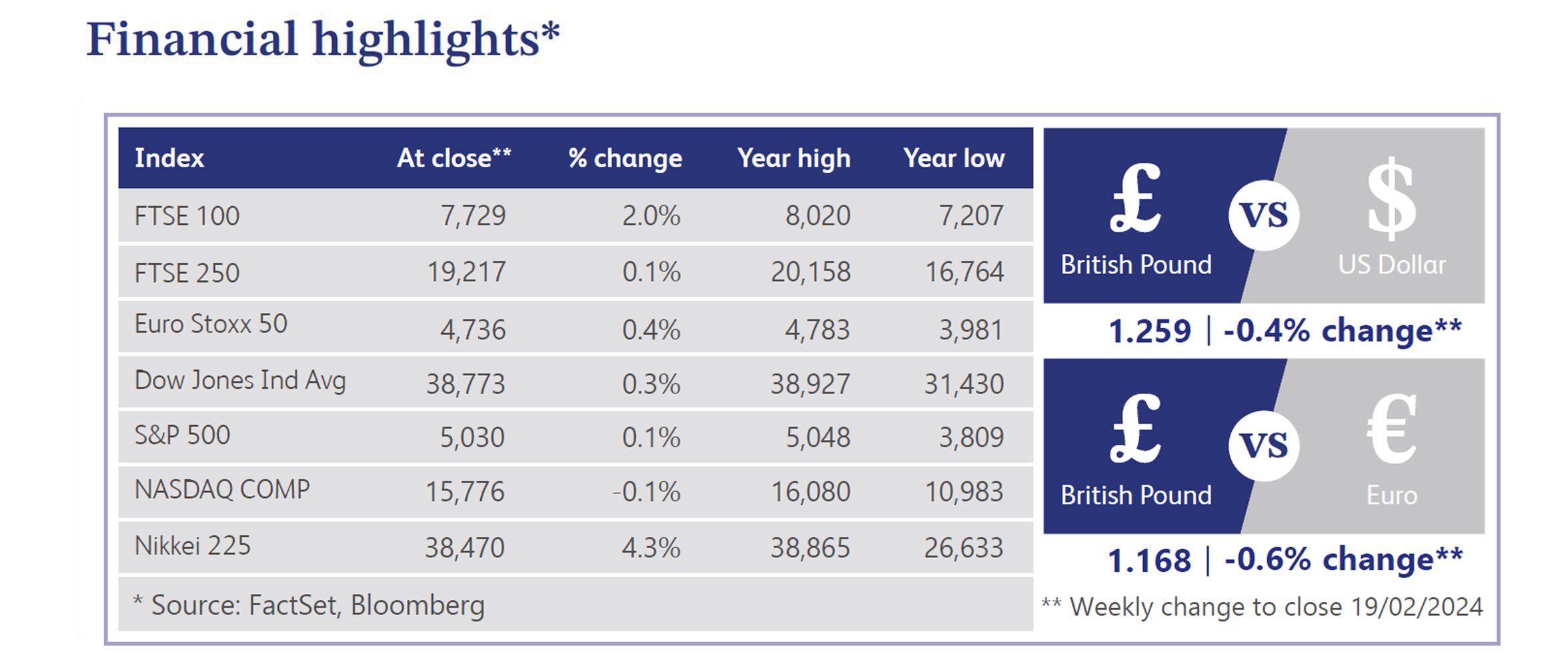

UK inflation data released last week provided a surprise as headline inflation remained steady at 4% year-on-year, defying expectations for a slight increase. The core Consumer Price Index ("CPI") was also below forecast at 5.1%. Monthly CPI figures declined 0.6%, contrasting with the anticipated 0.3% drop. Despite services inflation persisting at 6.5%, slightly below projections, economists are optimistic, forecasting a dip in inflation to 3.4% in February and a return below the Bank of England's ("BOE") 2% target by April.

January's official labour market data revealed resilience in the UK job market. The claimant count increased by 14,100, slightly below the consensus, and the unemployment rate stood at 3.8%. Payrolled employees rose by 31,000 in December, with an additional 48,000 in January. Average earnings including bonuses declined to 5.8%;excluding bonuses it reached 6.2%. These figures reflect a more robust labour market than anticipated.

The latest UK data triggered notable volatility in expectations regarding BOE rate cuts. After the inflation update, markets shifted towards anticipating at least three rate cuts by year-end, impacting gilt yields and pushing sterling below $1.2550. The labour market's resilience and US inflation figures had temporarily tempered rate cut expectations to 0.6% this year. However, the UK inflation update swung sentiment back. Money markets are now pricing for BOE easing which now aligns with pre-labour market data, with around 0.7% of cuts expected in 2024.

A City AM survey found that 43% of economists now foresee the BOE initiating rate cuts in May. The market expects a total of two rate cuts in the second half of the year. However, BOE Governor, Andrew Bailey, continued to play down rate cut speculation during his recent appearance before the House of Lords’ Economic Affairs Committee. While acknowledging weaker-than-expected January inflation, Bailey emphasised the need for more evidence before considering rate adjustments.

Official figures reported by The Telegraph highlight that Britain is experiencing its longest period of falling or stagnant living standards since records began in 1955. Output per person sharply declined at the end of last year, implying that the economy has failed to grow since early 2022 after accounting for population growth. This underscores the depth of the downturn in living standards, even as the nation grapples with the technical recession.

Savills' analysis indicates a £27 billion drop in the value of the UK housing stock in 2023, marking the first annual fall since 2012. High mortgage costs and financial pressures have impacted the overall value, emphasising the challenges faced by the housing market.

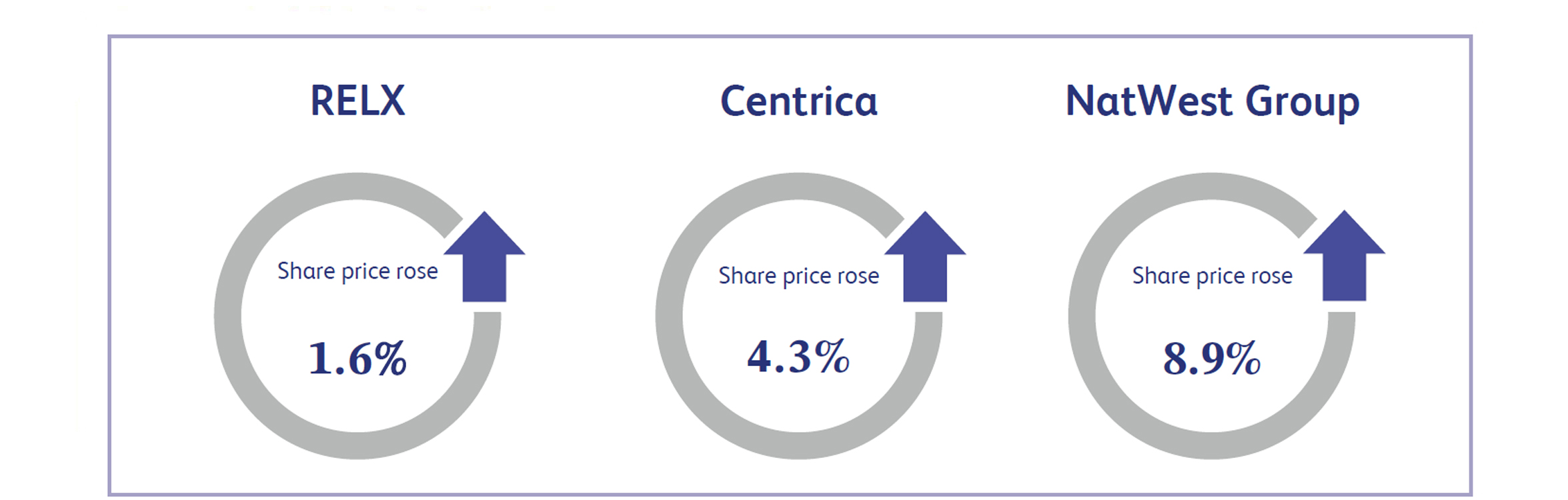

RELX, the UK based global provider of information-based analytics and decision tools, announced its final results last week which saw the company’s share price close the week approximately 1.6% higher. The company reported revenue of £9.2 billion for the period, an increase of 8% in comparison to last year's figures. RELX also announced a proposed full year dividend per share of 58.8p, an increase of 8% from the previous year, as well as completing a share buyback of £800 million during the period. Investors seemed to view the results as positive, resulting in the strong performance for the week.

Centrica, the international energy and services company, saw its share price close the week approximately 4.3% higher after announcing its final results. The company reported operating profit of £2.8 billion, compared to a consensus estimate of £2.6 billion alongside a dividend per share of 4p, beating expectations of 3.9p. The strong underlying performance from 2023 has continued into the first half of 2024, suggesting a positive outlook for the company which appears to have created a more positive sentiment in the market.

NatWest Group, a UK banking and insurance holding company, reported its final results last week which resulted in its share price surging approximately 8.9% higher. The company reported total income of approximately £14.8 billion, beating analyst expectations of £14.6 billion. NatWest also announced an on-market buyback programme of up to £300 million in 2024 which was viewed positively by investors and the market.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management's own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.