28 February 2023

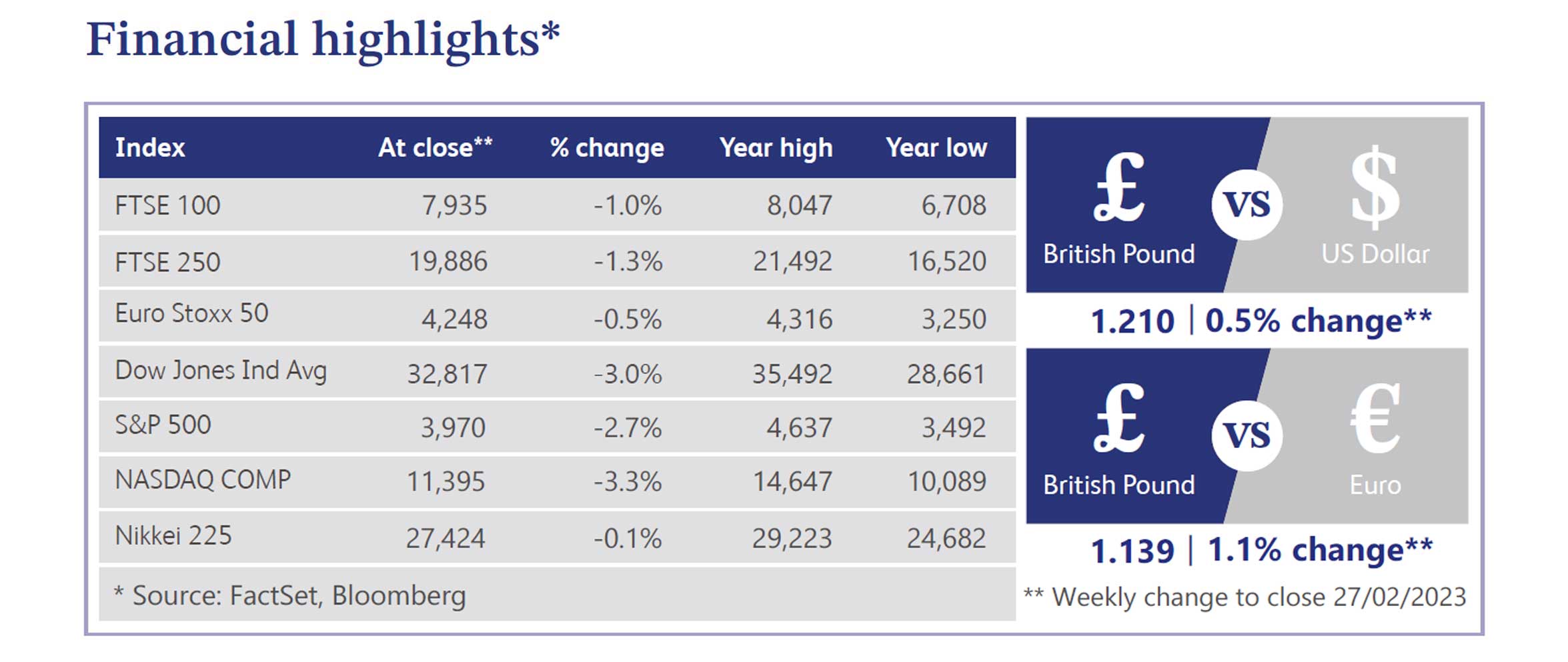

Global equity markets experienced slight declines over the week, with share prices stagnating from the market rally which began in October. In fixed income markets, yields broadly increased amid further anticipated interest rate rises and this put downward pressure on prices. This has also negatively impacted residential property with increased mortgage costs leading to price declines for the fifth consecutive month, according to Nationwide’s latest figures.

A raft of manufacturing and services data was announced early in the period, revealing mixed results. Surveys in the UK showed increasing production volumes, improving supply conditions and stronger demand for business services. This was despite a continued squeeze on consumer spending and higher borrowing costs with the results citing an improved global economic outlook and reduced domestic political uncertainty.

Prime Minister Rishi Sunak communicated that a new Brexit deal had been agreed upon for Northern Ireland. He expressed that this would improve the flow of trade within the UK, protect Northern Ireland’s position and safeguard its sovereignty. Sterling rose following the news.

The Office for National Statistics reported a £5.4 billion surplus in the UK government budget in January following a surge in self-assessment income tax receipts. This was the highest January figure since records began in 1999. Simultaneously, however, the interest paid on government debt reached the highest level since the same date. The Chancellor is due to announce his latest budget on 15th March.

The US Federal Reserve released the minutes from its most recent meeting which disclosed almost all members agreed to raise interest rates by 0.25%, with few pushing for a higher 0.5% rise. All participants expected rate rises to continue until there is greater confidence that inflation is on a sustained path toward target levels. While the overall monthly figures continue to decline, members stressed that some areas were much higher than others and that they would want to see a broader spread in price declines.

In Europe, the latest inflation figures were confirmed at 8.6% year-on-year, continuing their descent for the third month in a row. This was largely due to a slowdown in energy prices. Concurrently, inflation reached 4.6% in Japan, its highest rate in 41 years. This was more widely spread with upward pressure coming from all components including food, housing, clothing and medical care.

Europe’s largest bank HSBC reported a near doubling in its quarterly profits. This was driven by rising interest rates as margins were widened on its loans and mortgages. The announcement of a special dividend followed, as well as the expectation that it would return to paying quarterly dividends this year. The company did, however, report conservative forecasts as it faced increased pressure from competitors to raise the interest paid on cash deposits. Chief Executive Noel Quinn reported that the company would look to strip out layers from the bank's bloated management structure to reduce staff costs.

Trade kitchen supplier Howden Joinery posted a jump in yearly revenue and profits to December 2022 with a 4% rise in pre-tax profit and a 10.8% increase in revenue. This led to the announcement of a 5.6% increase in its dividend and a £50 million share buyback, showing confidence in the company’s direction. Despite warning that 2023 may be challenged by the impact of inflationary cost increases, the company will look to open new depots in the UK, France and the Republic of Ireland. Chief Executive Andrew Livingston commented that the firm will also look to improve its product range, optimise manufacturing and supply chain as well as develop its digital capabilities.

Aerospace and defence company Rolls-Royce's shares surged by almost 24% on Thursday with the company's annual results vastly surpassing expectations. The company recorded underlying profits of £652 million in 2022, which was £238 million higher than the previous year. This was largely attributed to recovering demand for international travel following the pandemic as it recorded a 35% year-on-year increase in flying hours. Despite the increased profits, the company stated that no additional shareholder payments would be made for the 2022 financial year, but pledged to increase its credit rating to investment-grade status.

Market Commentary prepared by Walker Crips Investment Management Limited.

This publication is intended to be Walker Crips Investment Management’s own commentary on markets. It is not investment research and should not be construed as an offer or solicitation to buy, sell or trade in any of the investments, sectors or asset classes mentioned. The value of any investment and the income arising from it is not guaranteed and can fall as well as rise, so that you may not get back the amount you originally invested. Past performance is not a reliable indicator of future results. Movements in exchange rates can have an adverse effect on the value, price or income of any non-sterling denominated investment. Nothing in this document constitutes advice to undertake a transaction, and if you require professional advice you should contact your financial adviser or your usual contact at Walker Crips. Walker Crips Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the London Stock Exchange. Registered office: Old Change House, 128 Queen Victoria Street, London, EC4V 4BJ. Registered in England and Wales number 4774117.

Important Note

No news or research content is a recommendation to deal. It is important to remember that the value of investments and the income from them can go down as well as up, so you could get back less than you invest. If you have any doubts about the suitability of any investment for your circumstances, you should contact your financial advisor.